The ZEC price eyes the $70 level despite the recent crypto market bloodbath so another breakout could follow Zcash’s latest drop to 50 AMA as we are reading in our Zcash news.

The low on-chain activity shows sluggish movements or a drop to the support range between $50 and $55. Cryptocurrenceis continue to bleed with almost no reversal signals on the horizon. Bitcoin aims for a $10,000 price range and Ethereum for $320. However, the ZEC price eyes the $70 price level, sending out signals of massive recovery that could reclaim the ground around $70. At the time of writing, Zcash is dancing at $63 after bouncing off the support at $60.

The privacy-oriented token is now holding above the 50 simple moving averages in the 480 minute-timeframe. On the upside, the price actions are capped by the descending trendline resistance while the RSI abandoned the downtrend for support at the midline. The continued leveling at the average 50 could demand more consolidation before a breakout emerges. Zcash could dip to support at 50 SMA before another reversal comes into the picture so gains above the trendline resistance which is expected to find an open path to $70. At this level here, the buyers will have to deal with the seller congestion at the 200 SMA while the crucial support is highlighted in the range between $50 and $55.

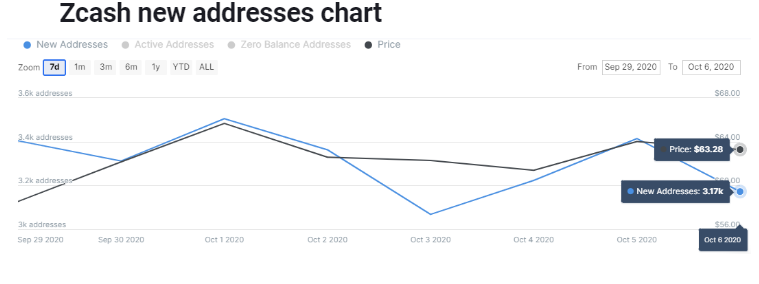

The 1-hour charts show a growing bullish grip as it can be seen from the MACD indicator. The bullish divergence beneath the MACD shows the growing bullish grip but ZEC is now trading above a short-term descending parallel channel as the bulls are preparing to push the price above the 100 SMA and the 50 SMA. Moving like this could invalidate the expected drop to $58. IntoTheBlock’s Daily New Addresses metric shows an increase in the number of addresses over the past week. The addresses topped 3500 at the start of October when ZEC/USD exchanges hand at 65. At the time of writing, the number started to retrace with addresses set at 3,700. If a number of new addresses hit lower levels, ZEC/USD could resume the downtrend and sabotage the uptrend overall.

The increase to $65 coincided with a surge in social volume according to the data provided by Santiment, showing that the surge happened after the Gemini crypto exchange added support for shielded ZEC withdrawals on October 1. The volume decreased later as the high social volume tends to precede spikes in the price of the asset. The lower social volume is characterized by falling price actions.

buy silagra online www.adentalcare.com/wp-content/themes/medicare/editor-buttons/images/en/silagra.html no prescription

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post