Zcash hits an exhaustion point while in its uptrend, despite the surge of nearly 60% over the past month. The data suggests that the social volume reaches new levels that previously indicated local tops. The different technical indexes only add credence to this possibility and signal a correction is coming. Let’s see more in the following Zcash news analysis.

If the correction is validated, the high correlation between ZEC and other cryptocurrencies could create trouble for the rest of the market. The on-chain and technical metrics suggest that the privacy-centric cryptocurrency- Zcash, hits exhaustion point which could have severe implications for the entire crypto market.

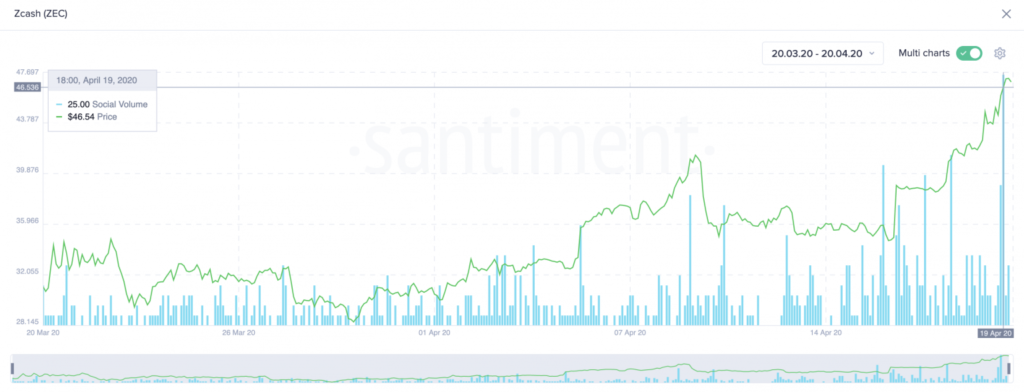

Zcash is up by about 13 percent over the past 24 hours and the privacy token increased from hovering around $29 to reaching a high of $47. This price level could represent a local top according to Santiment. The analytics company explained that the social volume of Zcash increased to a month high of 25 in the past few hours. The short-term signal is indicative of profit-taking opportunities but only if the metric continues at these high levels in the upcoming days.

There are multiple technical indexes that add credence to the bearish outlook. The TD sequential indicator has been accurate in the past when predicting local tops.

buy lasix online https://nosesinus.com/wp-content/themes/twentytwentytwo/inc/patterns/new/lasix.html no prescription

Over the past month, the technical index presented three sell signals in the form of green nine candlesticks which were all validated. After the bearish formations, Zcash dropped by 20 percent.

The TD sequential setup is providing another bearish signal in the form of a green nine candlestick and looking at the 200-twelve-hour moving average, it is highly likely that this signal will be validated. This way Zcash could drop for one to four candlesticks before going on with its uptrend. With the downward impulse, we could see the privacy altcoin dropping to 23.6% or 38.2% Fibonacci retracement levels. These support levels stand at $40 and $36.

However, a further increase in demand could protect the coin from the pessimistic outlook. Zcash has to break above the 200-twelve-hour moving average and turn the resistance level into a support level. With these circumstances and a spike in social volume, ZEC could increase to $54. The data from Bitfinfocharts reveals that Zcash and Bitcoin have a high correlation and the number one cryptocurrency along with Zcash will maintain an average correlation coefficient at 0.97 which resembles a strong positive linear relationship.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post