The upcoming Zcash halving poses a new question for the traders which is how to remain profitable after it? This is among the biggest concerns for the traders when a halving occurs so let’s find out more in the latest ZEC news.

The upcoming Zcash halving could help the asset reduce its annual inflation rate and make the coin profitable for the miners. Reward halving is quite common for different forms of cryptocurrencies and are known to impact the supply of the coin, difficulty, and price. For many cryptocurrencies, the halving mechanisms are embedded into the code so they can lower the generation rates and inflation which can also prolong the life of the coin during a time of increased demand.

This is what happened with the BTC network back in May when there was a block halving for the third time and it was reduced to 6.25 BTC. Now, it’s Zcash’s turn as the digital asset’s network will undergo its first halving in November at the block number 1,046,400. The biggest criticism that Zcash gets is the inflation rate which is higher than the one of its counterparts as the annual inflation rate is standing at 26.53%. This implies that the circulating supply of Zcash increased by 26% per year while most other forms of crypto have increased by 1.8% to 7%.

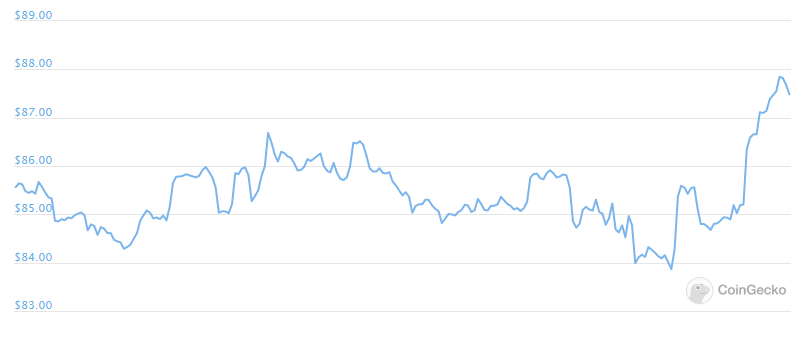

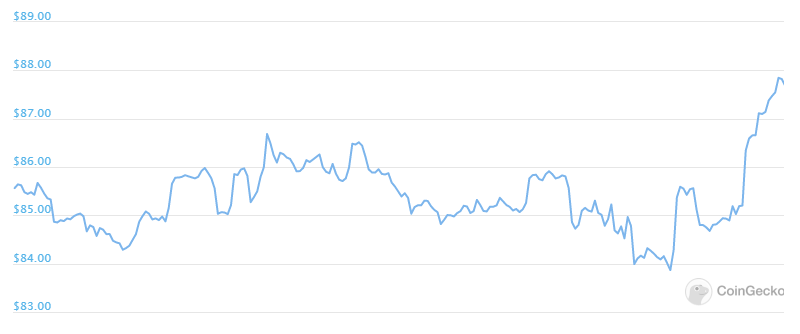

With the previous halving, we can see a positive impact on the price before and after the event. However, the Zcash halving poses questions for the traders as they expect the event to drop the inflation and to spark a long-awaited price increase. The reward structure faced a lot of backlash from the community as the founder’s reward is set to expire with the halving. This will be replaced with a new fund that will have 80% of the mining rewards allocated to miners and 20% will go towards infrastructure and market development.

The new reward structure will benefit the long-term development of the network but there are still some questions that the miners have to solve in order to remain profitable. The drop in reward and supply after the Zcash halving will lead to increased difficulty and it will need a high power operation to maximize the profits. There are two ways to solve this challenge: cost-effective miner hosting strategy, and upgrading the miner hardware.

A huge number of users are relying on Bitmain’s Antminer Z11 and Z9 in order to meet the network’s needs. These devices will take a huge hit after the halving and will be replaced with a high-powered Antminer Z15.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post