Circle’s stablecoin will be held entirely in Cash and US treasury bills according to the announcement today that it will revert to these methods as we are reading more in our latest USDC news today.

The Centre announced that it will revert to the short-term US treasuries and cash that back the industry’s second-biggest USD coin according to the recent blog post today from the Centre Consortium. Centre was founded by the Boston-based Circle and Coinbase back in 2018. Circle issued USDC while Centre oversees which of the entities are allowed to issue the stablecoin and use the API. Visa for example announced that it will start settling transactions in USDC. Stablecoins are pitched as cryptocurrencies that are pegged to the price of fiat currency and they are the main component of crypto markets that give speculators more access to a stable asset without having to convert to fiat.

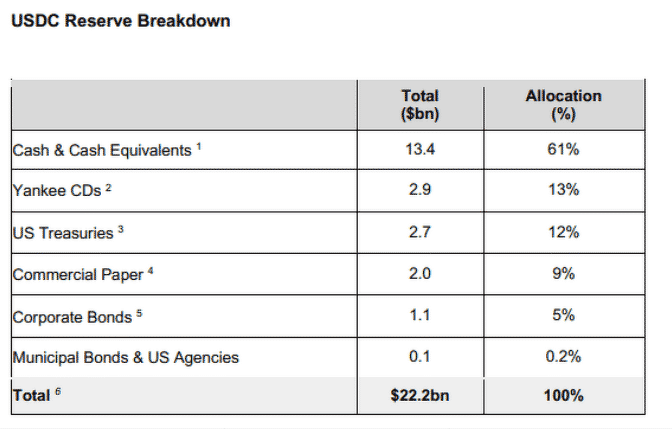

In this case, USDC is pegged to the dollar and the Centre also claimed that the stablecoins are 1:1 redeemable for the dollar that they track. However, the 1:1 backing came under fire as the circle revealed that the stablecoin was only 61% backed by cash and cash equivalents in this context can be money market funds and cash equivalents which are short-term securities. The blog post on Sunday stated that these updates will not reflect in the current backing disclosure but in future attestations conducted by the auditor’s Grant Thornton:

“Mindful of community sentiment, our commitment to trust and transparency, and an evolving regulatory landscape, Circle, with the support of Centre and Coinbase, has announced that it will now hold the USDC reserve entirely in cash and short duration US Treasuries.”

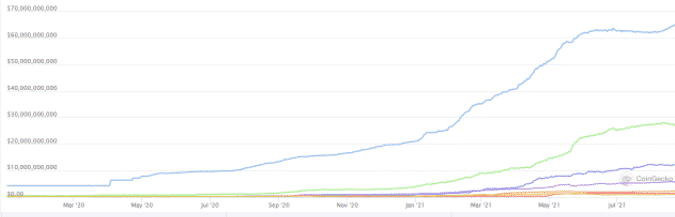

Circle’s stablecoin now commands a total market cap of $27.01 billion and made it the ninth biggest crypto according to CoinGecko. The biggest stabelcoin is Tether’s USDt with a market cap of more than $65 billion. Tether released a similar assurance report that outlines the backing and the report showed that the stablecoin’s cash and bank deposit backing was just 10% while in May the backing was 3%. despite the promises of full-cash backing, no stablecoin has $1 for every cryptocurrency but this hasn’t been a problem for the market with both stablecoins growing the past year so now Circle’s stablecoin will be held entirely in short-term US Treasury bills and cash.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post