The Circle stablecoin provider hit $9 billion in valuation after the new SPAC deal as we can read furhter in today’s latest cryptocurrency news.

In about six months, Circle doubled its valuation and as per the announcements, the latest $9 billion valuations came from the company’s announced new terms with the special-purpose acquisition corporation Concord Acquisition Corp. SPAC is also called a “blank check company” and it was erected with a purpose of raising capital via an IPO to acquire or even to merge with an existing company like Circle in this case. Concord and Circle announced plans to go public back in July and value the stablecoin provider at $4.5 billion while all of the same members are involved as from the original deal but it is simply that the two companies updated the terms and replaced the arrangement from last summer.

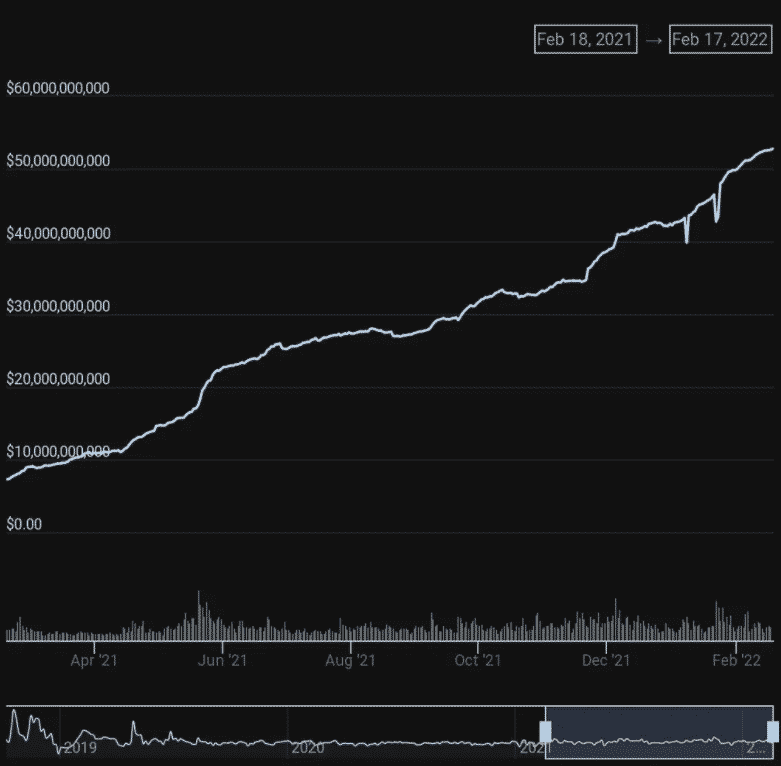

In a press release from Circle, the new valuation came in part to the continued growth of the US dollar-pegged stablecoin UDSC. The current market cap is under $53 million as per the data from CoinGecko. When Circle and Concord first struck a deal, the figure was $25 billion about half of today’s value. The chairman of SPAC and CEO of Atlast Merchan Capital, Bob Diamon, said that the updated valuation came in part due to Circle’s stunning growth.

The Circle stablecoin provider grew immensely and Diamond noted:

“Circle’s rapid growth and world-class leadership are underscored by a regulatory-first mindset fixed on building trust and transparency in global markets. We believe our new deal is attractive because it preserves the ability of Concord’s public stakeholders to participate in a transaction with this great company.”

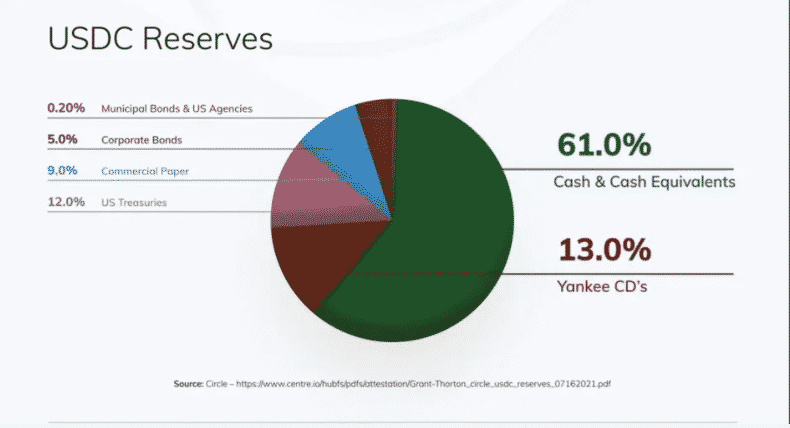

Despite the impressive growth, USDC will play another part in Tether’s USDT which now commands a market cap of about $79 billion. It is the biggest stablecoin in the industry but USDC has its own critics. The two biggest stablecoin providers in crypto came under attack for their claims that every digital dollar floating around the market is backed 1:1 for a real dollar. Last summer, however, Circle revealed that about 61% of the stabelcoin reserves at the time were held in cash or equivalents of cash. The remaining 39% was made up by a hodgepodge of US treasuries, commercial paper, and various bonds as well as Yankee CDs.

Tether hasn’t faired much better but revealed that just 10 of the backing at that time was in cash. Concerns about these reserves as well as the growth of the stablecoin industry also attracted a lot of attention from regulators in Washington. The Biden administration is also working to force stablecoin companies under the same rules as banks.

buy tadora generic buy tadora online no prescription

For now, these regulatory concerns don’t appear to be affecting Circle’s business plans.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post