Circle revealed backing for its USDC dollar-pegged stablecoin according to a blog post today that we read more about in our latest USDC news.

Stablecoin issuer Circle revealed backing for its USDC stablecoin. Stablecoins are pegged to the price of fiat currency and in this case, the US dollar uses matching currency denominated assets that are held in segregated accounts by the issuer. The total value of assets held in the accounts has to be equal to the number of issuer’s stablecoins currently in circulation. As per the report written by Circle’s accounts, Grant Thornton which was issued on Friday showing Circle held $22,176,182,251 in its account at the time of the report. Grant Thornton accountants verified that the figure equated to exactly one dollar for each USDC in circulation.

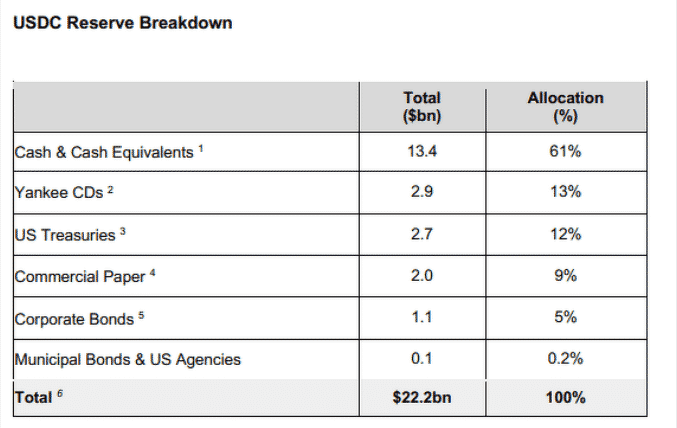

More than 60% of the number or $13.4 billion is held in cash. A quarter of the total reserves are split between Yankee Certificate of Deposits which is a type of savings vehicle denominated in dollars which accounts for $2.9 billion and the US Treasury securities accounts for $2.7 billion. The remaining 14% is split between commercial paper and corporate bonds. Circle outlined its three pillars of trust, accountability, and transparency for the USDC ecosystem.

The company pledged to maintain the highest level of the regulatory and prudential standards which are now in a state of uncertainty due to the increased regulatory scrutiny of crypto. Circle will continue to provide timely reserve attestations via Grant Thornton to show the public that the USDC is backed by adequate reserves as it did on Friday for the third time since it started issuing USDC. Circle’s last pillar is that it aims for a core economic activity underpinning USDC to be the inside of the perimeter of the US financial system. Public disclosure of stablecoins is not a legal requirement but Circle joints the leading stablecoin provider Tether in disclosing its operations.

As recently reported, The circulating supply of the USDC on Tron surpassed $108 million as per the data which could be another sign the traders are turning to blockchains that have cheaper transaction fees with faster speeds than what’s been going on on Ethereum. The achievement came a day after Circle said it added support for USDC on Tron and one of the stated goals of doing so was enabling the growth of the crypto in Asia and around the globe.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post