Bitfinex’s LEO token surged after the DOJ seized $3 billion in BTC from the 2016 Bitfinex hack as we recently reported in our cryptocurrency news.

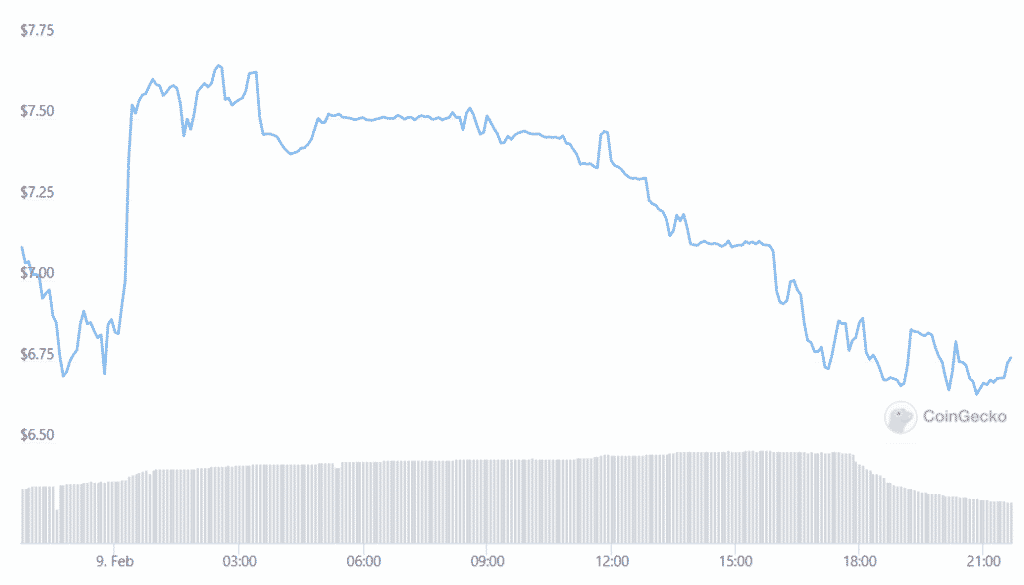

The price of Bitfinex’s LEO token surged after the DOJ seizure worth $3 billion in BTC. Now, the token UNUS SED LEO reached a new high of $8.14 after the DOJ announced the seizure of the stolen BTC from the hack in 2016. The price of LEO pulled back slightly since then with the token changing hands at $7.37.

This is still a huge increase of over 50% since the past 24 hours with over 80% of the last days’ tradign volume happening on FTX and Bitfinex. Launched in 2019, LEO is the utility token for the exchange and its affiliated platforms giving the holders a range of benefits like reduced trading fees and discounts on other products and services. After the launch, Bitfinex’s parent company iFinex used LEO to raise $1 billion that sold the newly minted token in exchange for Tether to replace the $850 million that it lost to the Panama-based bank Crypto Capital.

The latest surge that saw LEO moving up to 24th place in terms of the market cap can be attributed to the seizure of BTC from the 2016 hack that occurred on Bitfinex. According to the DOJ, the law enforcement seized 94,000 BTC linked to the hack and the total amount stolen from the hack now amounts to 119,756 BTC. Alongside the seizure, the law enforcement agencies also arrested a couple from New York City in an alleged connection with the case.

The couple was charged with an alleged conspiracy to commit money laundering that carries a sentence of 20 years in prison, alleging a conspiracy to defraud the United States that carries a maximum sentence of five years in prison. There’s another key property of the LEO token which is relevant to the investors in light of the recent seizure. According to the white paper, Bitfinex promised to use 80% of the BTC recovered from the hack, to purchase LEO in the open market and burn it. The exchange confirmed its commitment to the pledge saying that it will work with the DOJ to recover that seized BTC. The statement reads:

“If Bitfinex receives a recovery of the stolen bitcoin, as described in the UNUS SED LEO token white paper, Bitfinex will, within 18 months of the date it receives that recovery use an amount equal to 80% of the recovered net funds to repurchase and burn outstanding UNUS SED LEO tokens.”

Bitfinex added that in addition to opening the market transactions, the repurchases can be accomplished by acquiring LEO in OTC trades like trading BTC for UNUS SED LEO. Though BTC remains in the custody of the DOJ, the LEO tokens cannot be burned.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post