Eleven people that were linked to the Forsage crypto pyramid scheme were charged by the SEC for taking part in the Ponzi scheme. Of these, two have already consented to pay civil penalties.

On August 1, the Securities and Exchange Commission of the United States filed charges against eleven people linked to Forsage for supporting and taking part in the Forsage cryptocurrency pyramid scam, through which they were able to earn more than $300 million in total.

According to the SEC, the defendants include additional members of the Crypto Crusaders organization who were involved in promoting the Ponzi scheme, as well as 4 founders who were last seen in Russia and 3 promoters who are currently in the United States.

Forsage functioned for two years as a pyramid scheme

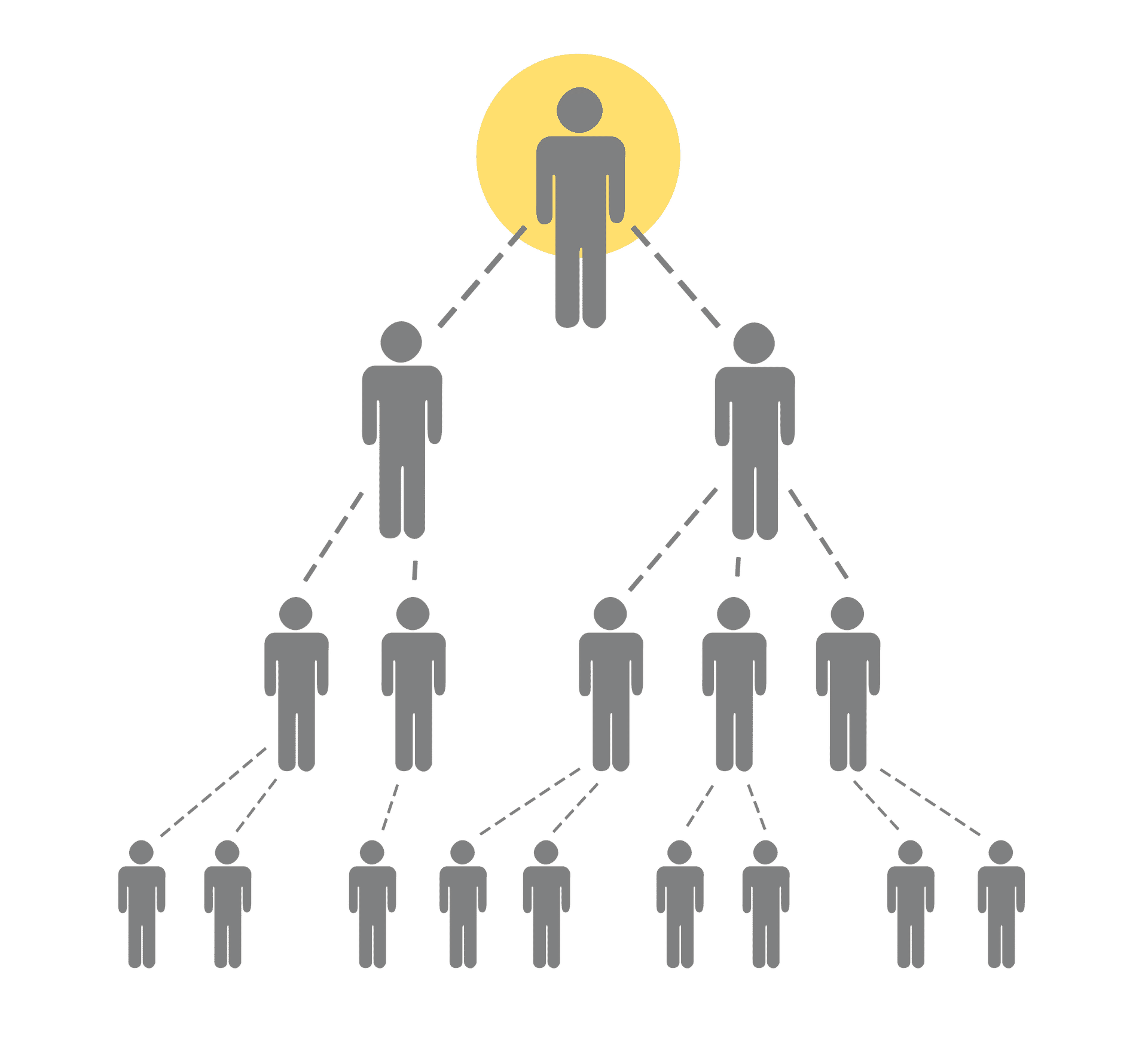

The idea behind the creation of Forsage was to act as a link between Binance, Ethereum, and Tron. The platform was designed to enable the execution of smart contracts across several chains. However, for two years, it ran as a Forsage crypto pyramid scheme, collecting funds from new investors to pay out existing ones and payout recruiters.

In late 2020 and March 2021, the SEC allegedly delivered cease and desist letters to Forsage; however, the network’s creators chose to disregard authorities and instead kept disputing the claims of cryptocurrency fraud through their YouTube accounts while promoting the use of the platform.

Carolyn Welshhans, acting chief of the SEC’s Crypto Assets and Cyber Unit, said “Fraudsters cannot circumvent the federal securities laws by focusing their schemes on smart contracts and blockchains,” harming small-scale investors who put their savings in these kinds of platforms on the basis of the promoters’ assurances.

To resolve the accusations brought by the SEC, two defendants with US addresses agreed to pay disgorgement and civil penalties as assessed by the court in exchange for their release from further liability.

The SEC and FBI Work Together to Combat Crypto Crime

The SEC has charged numerous people after crypto-related activity, including a former Coinbase CEO.

The SEC has taken a more active role in enforcing the law against individuals who use cryptocurrencies to promote scams, theft, and pyramid schemes, among other illegal activities, as evidenced by the arrest of Ishan Wahi, the first insider trading case within the cryptocurrency industry to be closed by the SEC.

Read more about our latest cryptocurrency news.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post