CREAM shoots 54% after the Binance listing in a sharp reversal rally, as we are looking into it some more in the latest altcoin news.

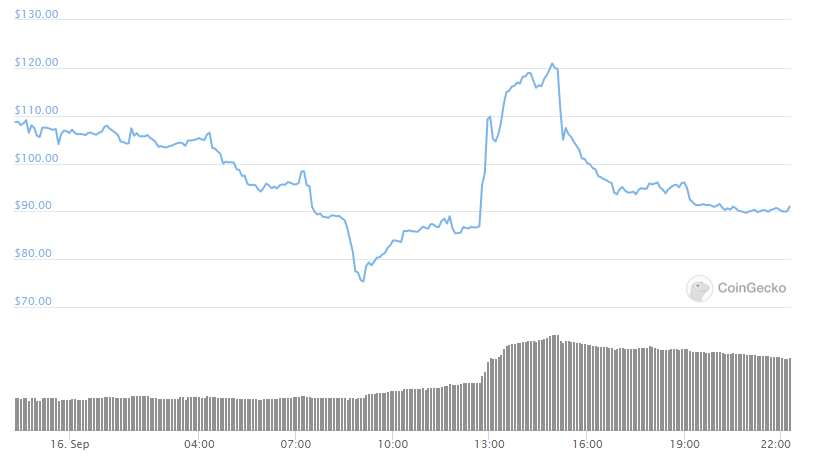

The Malta-based trading platform will list the CREAM/BNB pair as well as the CREAM/BUSD trading pair according to the announcement. This will enable the users to deposit and trade their CREAM tokens against Binance Coin and the US-regulated stablecoin BUSD. The trading pair surged by about 54% in the past three hours of trading after the announcement was made. The pair hit an intraday high of $120 and the gains also came after the prolonged price action on the market. CREAM shoots up after the weekly rally of the lows at $0.001 to as high as $279. The upside move took cues from the market craze in the DeFi space.

CREAM is a part of the decentralized lending platform named Cream Finance and serves as a governance token for the protocol that users are able to use as a permissionless borrow or lend service. Rather than the interest rates being set by individuals, CREAM determines them “algorithmically based on the proportion of assets lent out.” The project grew into the conscience of yield hunters after binance decided to support the protocol of the newly launched blockchain Binance Smart Chain. This protected CREAM finance from the ETH gas fees.

Despite the strong fundamentals, the drop started appearing on the Defi market due to the bad technicals. The CREAM/USD pair became the first victim of the massive dump which started during the $279 high. The profit-taking spree started and crashed by 73 percent at 0600 GMT today. It rebounded sharply after the news of the listing emerged which left many in the crypto space worried about the pump-and-dump movements. Micahel van De Poppe said:

“I sincerely don’t understand the fact of projects needing months to get a potential listing on Binance,” he said. “But, then, complete garbage like $CREAM and $SUSHI gets listed instantly with a bullshit reason of ‘becoming obsolete’. A complete sh**show for crypto and space.”

In the meantime, traders argued that binance was attempting to compete with the emerging decentralized exchanges such as Uniswap. The concerns got bigger when Cream finance confessed about facing a bug in the software in its source code. The DeFi platform commented that it paused staking due to the input error.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post