VanEck’s Tron ETN will go live on the Euronext exchange as one of the leading European stock exchanges in a short time as we are reading more in our latest Tron news.

VanEck continued with crypto-related exchange-traded notes in Europe by launching these products tracking the Solana performance as well as Polkadot’s on Xetra Deutsche Borse. Tron’s ETN went a step ahead as it will go live ont the Euronext in Paris and Amsterdam and updated the project’s founder. VanEck as the global investment manager, noted this week that it had three new ETN’s launched on the Germany Xentra exchange for Solana, Polkadot, and Tron. The company’s portfolio of ETF notes tracking the performance of various digital assets continues to increase.

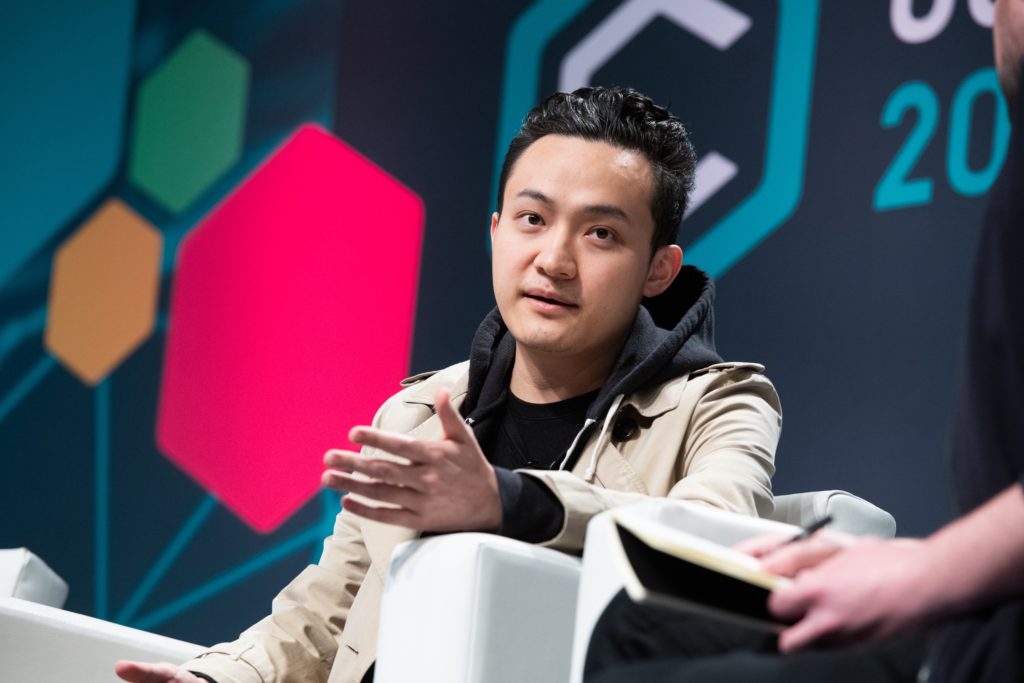

The CEO of Tron Justin Sun later updated that VanEck’s Tron ETN which has the ticker VTRX will also be listed on the Euronext stock exchange in Amsterdam and Paris. Sun concluded that TRX ETN continued to be favored and supported by the global mainstream market and he thinks this is a crucial step for the company’s compliance and globalization strategy so it could also enable investors to buy the native token without borders and low threshold. VTRX should start trading on September 24th.

While VanEck had success with the ETN listings in Europe and tries for an exchange-traded fund in the US with saw little to no progress. The company filed a few applications with the SEC to launch the BTC ETF and it had to withdraw a few of the earlier filings while the Securities and Exchange Commission delayed the decision on the latest one at the beginning of the year.

As recently reported, The regulatory body has since then extended the deadline review. The SEC delayed the ruling and extended its review of VanEck’s Bitcoin exchange-traded fund app once again and the regulatory body said a day ago in an extension notice that it will give an answer on whether or not it will approve the ETF. New York-based asset management company is awaiting new approval from the SEC from its December 2020 BTC ETF Application. VanEck made an amendment to the app in March and since then the SEC delayed giving it an answer. A Bitcoin ETF is an investment tool that allows investors to buy shares that represent the biggest crypto by market cap while other ETFs like gold, real estate, or foreign currency are very popular in the US.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post