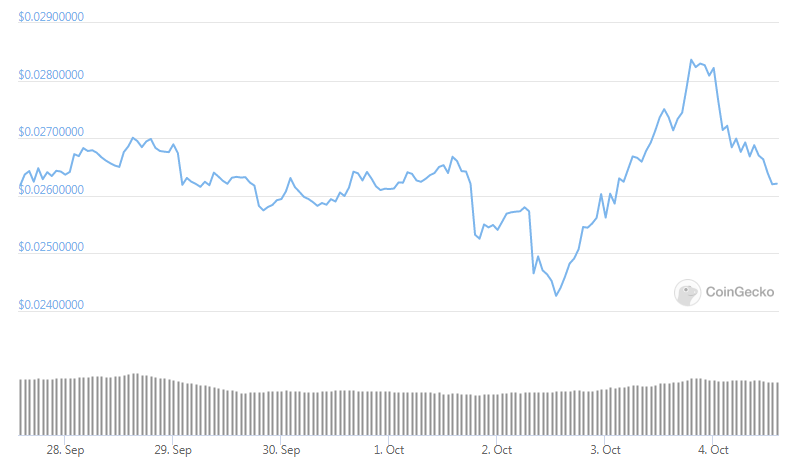

TRON aims higher after the recent 10% increase over the past 24-hours, defying the stagnation in Bitcoin’s price and the ETH local lows. Bitcoin and ETH have gained around 1 percent in the past day so TRON seems to be outperforming them today, as we are reading in our latest TRON trx news.

The latest Tron rally came after the blockchain started considering a pivot to offer decentralized finance applications to its users. So far, it has been successful with many blockchain analysts noting a strong uptick in transaction volumes. Therefore, Tron aims higher after the recent 10% increase which came shortly after the critical report by the Verge. The report suggested that there are large internal struggles in the Foundation itself and BitTorrent which was acquired by the company. The current uptick in the price of TRX coincides with the extremely positive quarter for TRON in terms of the on-chain fundamentals.

DappRadar, the crypto data tracking site, reported that the activity on TRON increased by about 265% on a quarter-over-quarter basis and most of the growth was triggered by TRON’s Defi applications which saw a 900% uptick in usage. TRON’s successful pivot came as ETH saw huge transaction fees as a result of the uptick in transaction demand which came from DeFi. Some believe that TRON’s applications are seeing more adoption because the retail users with less capital are trying to find a way to easily deploy their capital in DeFi.

Q3 2020: @Tronfoundation @justinsuntron

– Activity on #TRON increased by 265% in Q3 2020 compared to Q2 2020.

– #DeFi category spiked by 899% (@DeFi_JUST @defi_sunio)

– Exchanges grew by 641%. (#JustSwap, @TronTrade)

3 months data in 3 minutes: https://t.co/xN4TCKoJ3K pic.twitter.com/xHHd9FtM4Z

— DappRadar (@DappRadar) September 30, 2020

While TRX could have fundamental and technical merits to boost it higher, the price trajectory Is somewhat dependent on BTC. Luckily for the TRX holders, analysts are optimistic about Bitcoin’s possible to stay resolute in the face of a bearish event. Commenting on the positive ramifications of the latest BitMEX charges from the CFTC, Willy Woo wrote:

Fundamentally the market is scared for all the wrong reasons. MEX did NOT get hacked. No traders will lose coins. Futures exchanges will clean up their practices. We’ll see less volatility, less scam-wicking, more spot volumes, more organic moves, more institutional money.”

Woo elaborated further that the pure on-chain trends show how Bitcoin’s ball remains in the bulls court not in the bears’ one.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post