The Tezos price could surge 50% as the founders Arthur and Kathleen Breitman hinted that they would be stepping away from the crypto project. The recent exclusion of the Tezos Technical Advisory Committee by Arthur and Kathleen’s interest to run the upcoming blockchain-game on another blockchain rather than the one of Tezos (XTZ), doesn’t seem to be influencing the price.

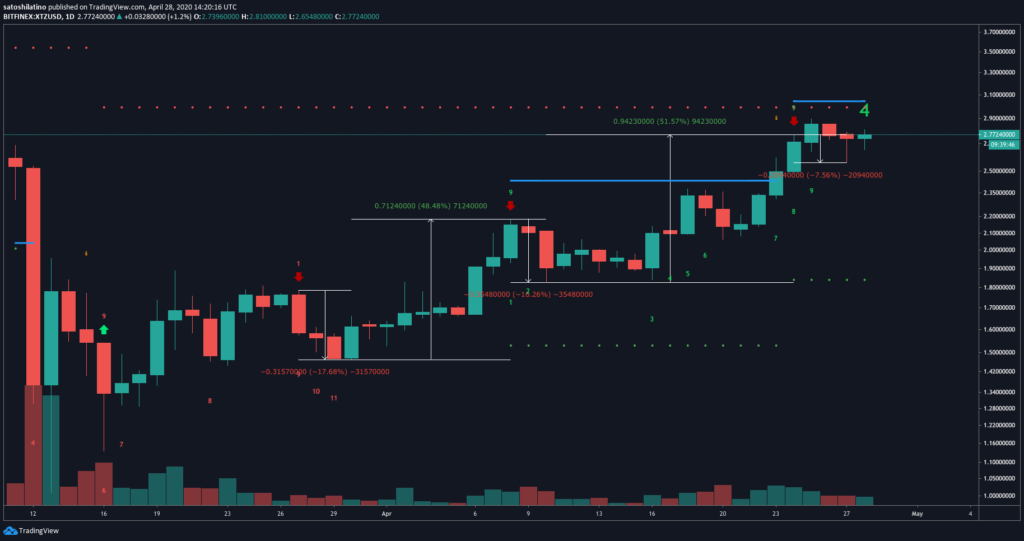

In our Tezos news today, we can see that the Tezos crypto community was able to easily shrug off the FUD and to recover the recent losses incurred during Black Thursday. XTZ surged by about 187% and a lot more technical indexes show that the Tezos price could surge again. The Tom Demark TD sequential indicator was extremely accurate at predicting the local tops on the one-day charts for XTZ. The index was able to predict a 19% decline that Tezos received on March 27. During that time, it showed a sell signal in the form of a green nine candle which transitioned into a red one.

A few days later, the TD setup formed the same bearish pattern that suggests that Tezos was bound for another retracement and the selling pressure behind XTZ increased and helped the price to go down by 16%. A similar event happened on April 21 and the altcoin dropped by 7 percent after the sell signal was given. The most interesting part about the corrections usually is that tezos increases by about 50 percent. After the recent pullback, the current levels show another accumulation zone so Tezos could be preparing to start testing the $4 high.

Such a bullish outlook could seem speculative once the substantial upswing has past but this cannot be omitted. As the Bitcoin halving approaches, the crypto market could soon enter into another period of volatility. Under these circumstances, a spike in demand for Tezos could allow it to break above the resistance at the $2.90 level. The bullish momentum is usually accompanied by panic buying to investors that seem to get a piece of the action.

XTZ could shoot up to test the next levels at $3 and $3.7. The increase in supply could put in jeopardy the optimistic scenario since a rejection could plunge the XTZ price to the 78% Fib retracement level.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post