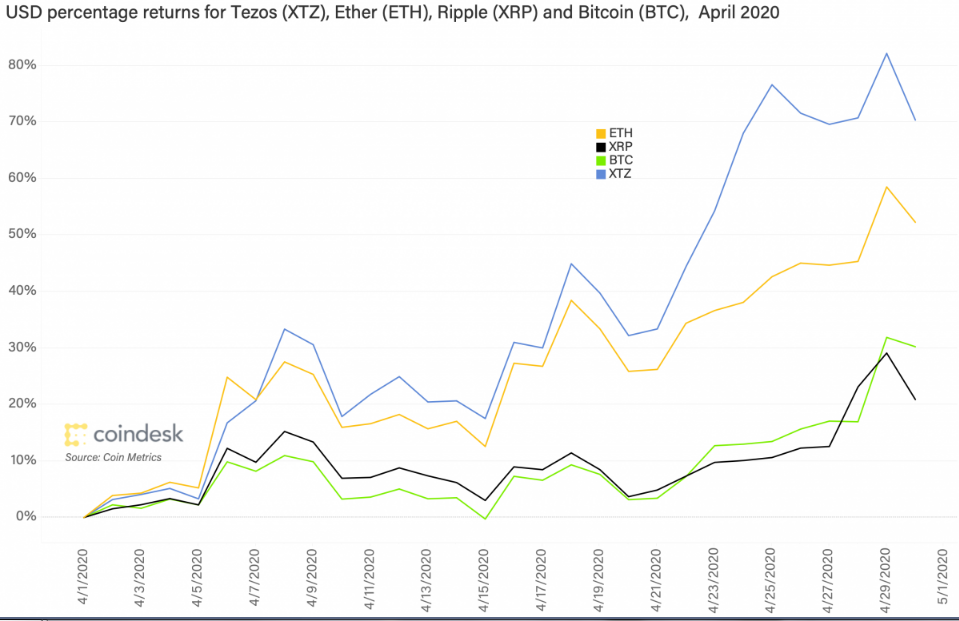

Tezos jumped 83% in April alone and beat most of the crypto assets including Bitcoin, Ripple, and Ethereum as we can see in the analysis today in our Tezos news.

Tezos became one of the largest and most prominent altcoins among the emerging market of digital coins known as ‘’staking tokens.’’ Tezos jumped 83% in April which is the most from the other assets that have a market value of at least $1 billion. This increase is more than double the previous 37% gains for Bitcoin which is the largest asset by market value which mostly benefited from speculation that an inflation hedge will be useful as the Federal Reserve and other banks inject billions of dollars in emergency liquidity funds.

Ethereum’s ETH increased 62% during the surge in growth for the US-based stablecoins that are built on the ETH blockchain. The investors’ interest also increased for decentralized finance while Ripple’s XRP increased by 30%. The staking tokens provide the holders with the right to get involved in the blockchain governance which is similar to the way the shareholders vote in a company’s board of directors. This gives them the ability to earn a share of the new tokens by getting a bond or a dividend.

The strong performance of Tezos happened mainly because of the increased interest from the investors in the staking returns according to Joseph Todaro who is the managing partner at Blocktown Capital, a company that specializes in digital currencies. Some of the crypto exchanges offer staking services which make it extremely easy for investors to participate so Tezos benefited a lot from the new recent listings by Bitfinex and Binance.

Ethereum’s token is the second-biggest cryptocurrency after Bitcoin and it plans to upgrade to a staking model in July. Some of the analysts believe that ETH generated a lot more enthusiasm among the speculators because of the transition. Nonetheless, Tezos doubled on a year-to-date basis despite the increased volatility in the larger coins. One important thing for the traders is that Tezos has a market value of $2.1 billion and it has a huge chance of making great losses alongside the fast gains. Todaro explained:

“The price movement of any given crypto asset is partially dependent on current investing narratives.”

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post