Bitcoin Suisse offers Tezos staking for institutional investors and holders in custody audited by PwC as we are reading in the XTZ news below.

The financial service company Bitcoin Suisse announced they will offer a high-security staking process for Tezos holders. The large organization claims that the addition comes right after the increased interest from institutional investors to the staking services for digital assets. According to the announcement, the demand from institutional investors to digital assets and various crypto-related financial products has been increasing over the past few months. Aside from serving as a custodial, Bitcoin Suisse offers Tezos staking through its PwC audited custody solution.

The organization already manages about $1 billion in assets and it will now allow XTZ stakers to do it with the security of an institutional grade-crypto custody provider. The stakeholders can assign the assets to a staking address that participates in the operation of the Tezos protocol and will earn a reward for the XTZ owners. The statement also informed that the Swiss company will provide a complete package for asset managers and high net worth individuals by utilizing custody services through the Bitcoin Suisse Vault coupled with the staking services on the platform. Philipp Vonomoss, the head storage at the platform said:

“We are excited to be adding XTZ to the Bitcoin Suisse Vault, thereby making XTZ available for clients requiring a fully audited custody service. We are also very impressed by the development of the Tezos ecosystem and by including XTZ in our institutional-grade infrastructure are proud to contribute to that development.”

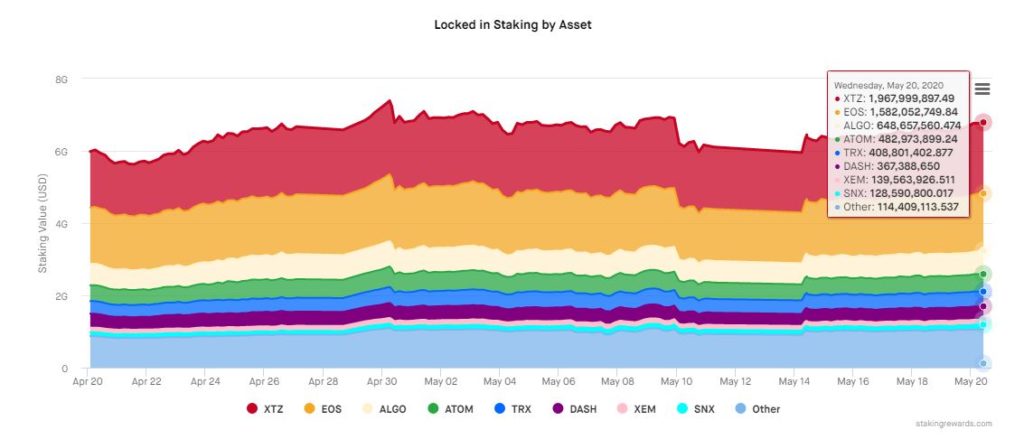

The CFO and Head of operations at the Tezos Foundation Roman Schnider noted that the addition of XTZ on Bitcoin Suisse is another major step towards more institutional adoption. Staking Tezos has been popular among crypto investors over the past few months since many digital asset exchanges are now offering XTZ staking including Binance, Kraken, and Coinbase. The increased interest was explained in a report last month showing that Tezos has become the leading coin in terms of assets locked in staking. At that time, the amount equal to $1.8 and that number jumped to about $2 billion so now XTZ is in the lead.

As far as the pricing goes, Tezos was on the rise since the Black Thursday back in March where the asset dropped to below $1 during the massive sell-off.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post