USDT recorded new high against the Russian ruble as the inflation hit hard as an immediate countermeasure against the inflation of fiat currency so let’s read further in our Tether latest news.

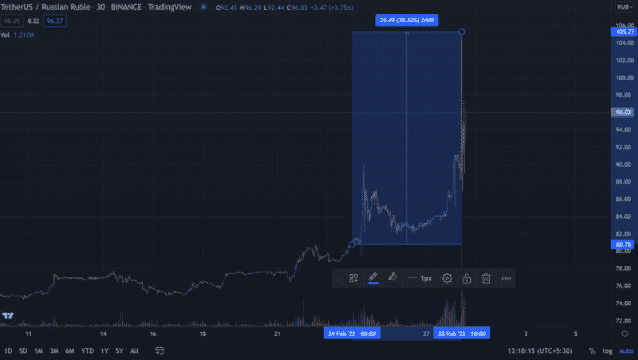

The United States dollar-pegged stablecoin Tether witnessed a surge of over 30% in five days against the Russian ruble outlining the heavy impact of the ongoing war on the traditional financial system. The data shows that the ruble is undergoing inflation with the USDT/RUB trading pair for the first time in history and crossed 105 rubles. Before the spike, the USDT/RUB pair maintained a steady market price below 80 rubles with the commencement of the war in Ukraine, the ruble’s market price against USDT surged and surpassed 90 rubles.

First, we commit to ensuring that a certain number of Russian banks are removed from SWIFT.⁰

It will stop them from operating worldwide and effectively block Russian exports and imports.— Ursula von der Leyen (@vonderleyen) February 26, 2022

With tensions escalating, the European Commission announced more plans to remove Russian banks from the SWIFT system. At the same time, the value of the ruble saw a crash and continued to lose the spending power by 30% that was deleted by inflation which is how USDT recorded a new high against the ruble.

buy kamagra online pavg.net/wp-content/themes/twentytwentyone/inc/en/kamagra.html no prescription

As an immediate countermeasure against the rising inflation of fiat currency, the central bank doubled the key interest rates from 9.5% to 20%:

“The increase of the key rate will ensure a rise in deposit rates to levels needed to compensate for the increased depreciation and inflation risks. This is needed to support financial and price stability and protect citizens’ savings from depreciation.”

In addition, the government asked Russian companies to sell about 80% of the foreign currency revenue with threats related to a complete international financial ban prevails. On the flip side, BTC and altcoin trading volume on Ukraine crypto exchanges spiked more than 200% with the growing concern about fiat stability. For example, major crypto exchange Kuna whose volumes were under $1 million in February and spiked to almost $4.1 million in three days. The National Bank of Ukraine also implemented cash restrictions like withdrawal limits and banning cross-border foreign currency purchases.

As recently reported, Ukrainians were paying a huge premium over the US dollar for Tether’s stablecoin after Russia invaded the country in the early hours on Thursday. The price of USDT on the popular crypto exchanges in Ukraine jumped by 5% in the past day to hit 32 Ukrainian hryvnia which is the national currency of the country.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post