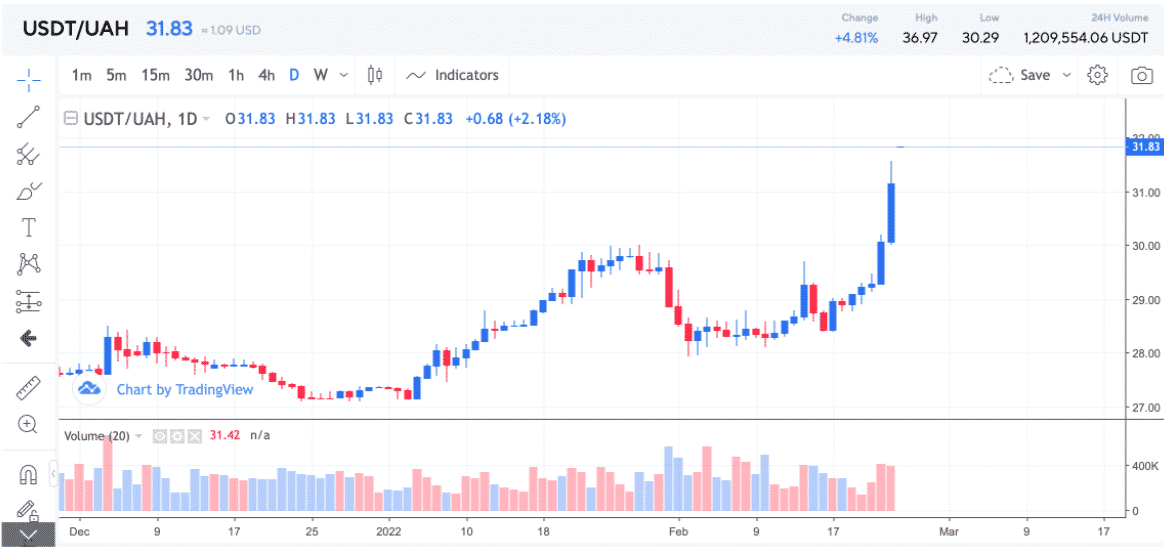

Tether’s stablecoin reaches over $1 on Ukrainian crypto exchanges while it is supposed to have a value of $1 since it is linked to the dollar so let’s find out more today in our latest Tether news.

Ukrainians were paying a huge premium over the US dollar for Tether’s stablecoin after Russia invaded the country in the early hours on Thursday. The price of USDT on the popular crypto exchanges in Ukraine jumped by 5% in the past day to hit 32 Ukrainian hryvnia which is the national currency of the country. Tether’s stablecoin reaches $1.10 per USDT while it is supposed to be set at $1. The tensions between Russia and Ukraine enhanced and many citizens are looking for a safe haven to keep their assets so most traditional crypto assets like BTC or Ether remained very volatile with Ukrainians are choosing to put their money into stablecoins like Tether.

Across crypto markets, USDT will hold fast to the $1 peg and as of press time, USDT was changing hands of 99.9729 cents based on the data feeds from many of the world’s largest exchanges. There’s a limited supply in Ukraine of USDT as the biggest stablecoin by market cap at $80 billion. This is becoming a problem as Kuna founder Michael Chobanian explained:

“The majority of people have nothing else to choose apart from crypto. We’re talking about millions of dollars of cash that wants to go into crypto … but we can’t find people who are willing to do the opposite, sell it.”

Tether Holdings Limited released its quarterly assurance opinion that shows a 21% decrease in commercial paper holdings in the last quarter. In a blog post on the Tether website, the company says the new figures show that the group’s reserves held for the tokens issued exceed the amount required to redeem the issued digital tokens.

Tether also revealed a breakdown of the reserves for the first time since 2014.

buy viagra super dulox force online www.ecladent.co.uk/wp-content/themes/twentyseventeen/inc/en/viagra-super-dulox-force.html no prescription

About 76% of Tether’s reserves were held in cash or cash equivalents while the remaining quarter was held in different secured loans, bonds, and other investments which included Bitcoin. Under cash and cash equivalent, the commercial papers held by the majority were with a share of 65%.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post