Tether’s popularity in China has just started a new wave of crypto crackdowns as the asset saw massive inflows of capital throughout 2020 with much of it coming as a result of the turbulences on the market. In our latest Tether news today, we take a closer look at the market developments.

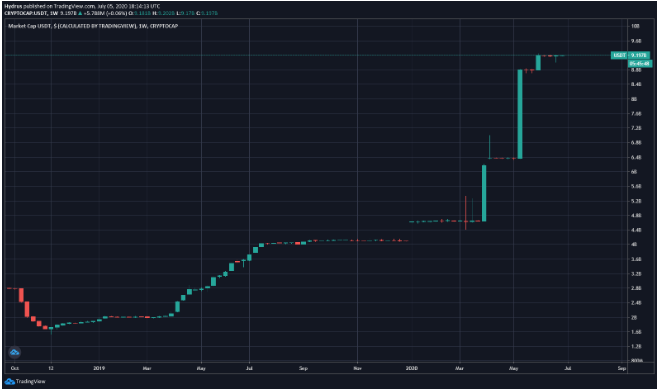

Investors in countries where they have access to safe haven fiat currencies have widely begun buying USDT to hedge their portfolios. This causes stablecoin’s market cap to see some huge growth climbing over 100% since the start of the year and most of the money originated from China. The country seems to be starting a new wave of crypto crackdowns because of Tether’s popularity that is ever increasing.

According to a China-focused report, the government is focusing the crackdowns on OTC trading with a few agencies and government-linked companies leading the efforts to stop crypto trading in general. In a report, they noted that USDT has a purpose in the country to aid money laundering in the country. The US dollar is thought to be extremely secure and to hold during times of global economic turmoils. The stability is due to the size of the country’s economy as well as the power held by the central bank. With the pandemic-related economic decline, most of the fiat currencies shed a huge amount of their value while USD remained stable.

This led many individuals in the country to turn to crypto-based solutions and to hedge their portfolio using different stablecoins such as Tether. The growing popularity of USDT in China helped to lead the market cap to the recent $9.2 billion from the past $4.6 billion in January. It doesn’t seem that these inflows are slowing down either and they will continue until the economy starts recovering. The Chinese government seems to have taken notice of the meteoric growth seen by Tether’s USDT.

According to a commentator in China, the country is conducting a major crackdown on OTC crypto trading mainly focused on USDT:

“The crackdown on OTC in China since last month is by the far the most strict and widely affected one, is caused by USDT is widely used for money laundering… the action [is] led by the PBOC, ministry of public security, central administration of customs, CBIRC, union pay…”

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post