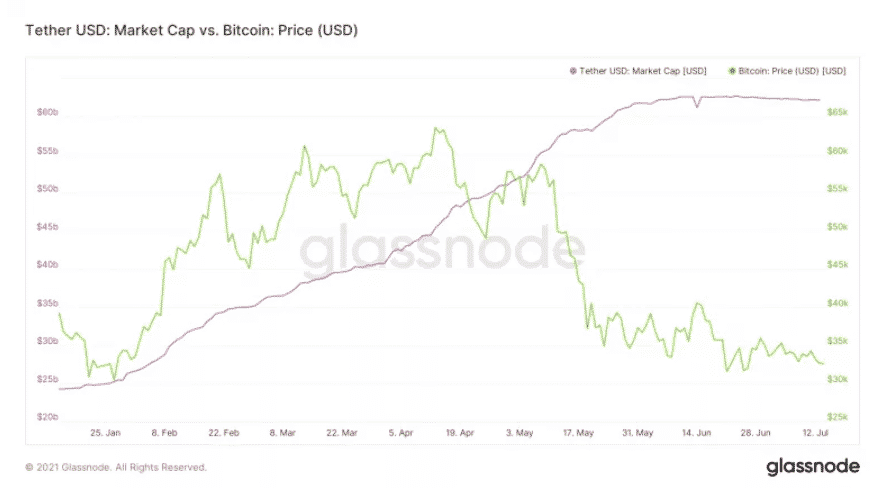

Tether’s money printer hasn’t printed new coins in weeks and there are a few reasons according to analysts why the growth reached a stop as we can see more in our latest Tether news.

The parabolic growth in the market cap of Tether came to a halt at the end of May just as Bitcoin’s price came off its highs. With Bitcoin trading in a range of $30-$40, a new round of chatter has been circulating linking the two events and questions emerging whether Tether stopped pumping up the price of BTC?

According to analysts and market participants, the sudden pause of Tether’s money printer revealed that the most traded crypto in the world is seeing a dominance threatened by three challenges that created the perfect storm to rattle a stablecoin. One of the reasons was China’s crackdown making it hard for traders to buy USDT coins with fiat. Regulatory pressure around the world is increasing as well as one executive from Tether argued that the trend is not exclusive to the token.

buy vardenafil generic buy vardenafil online no prescription

Paolo Ardoino who is a chief technology officer said:

“Demand for tether ebbs and flows, and has been impacted by lower demand in recent weeks.”

The crypto crackdown in China on mining and trading hurt bitcoin’s prices which are down by 52% as of now from the previous high of $64,928. Another victim of China’s renewed crypto crackdown is USDT coins, the stablecoin’s success was attributed to its dominance among Chinese traders and investors as they use the dollar-pegged stablecion as an on-ramp to crypto markets via OTC brokers because the fiat-to-crypto trading or buying digital assets with cash remains illegal. Annabelle Huang who is a partner at Hong Kong-based Amber Group said:

“It is extremely difficult to [go] on and off-ramp in China [to crypto]. A lot of the OTC merchants have stopped deals.”

With bitcoin having a hard time moving above its current range of $30L there is no incentive for new cash in China to enter the market. Former vice president and partner at Singapore-based Matrixport Rachel Lin said:

“Tether’s market in Asia is mostly through OTC merchants, and with less cash going into the market, there is less demand for tether.”

Crypto lender Babel said that it cut its interest rates for USDT deposits because of the weak demand for stablecoin. It seems that China’s crackdown on crypto AML activities remains ongoing. Reports show that Hong Kong customers shut down a local AML syndicate that used crypto-like USDT to process illegal funds worth $155 million.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post