Tether’s market share drops as the market leader lost some of its shares to its rivals as we can see more in our latest Tether news.

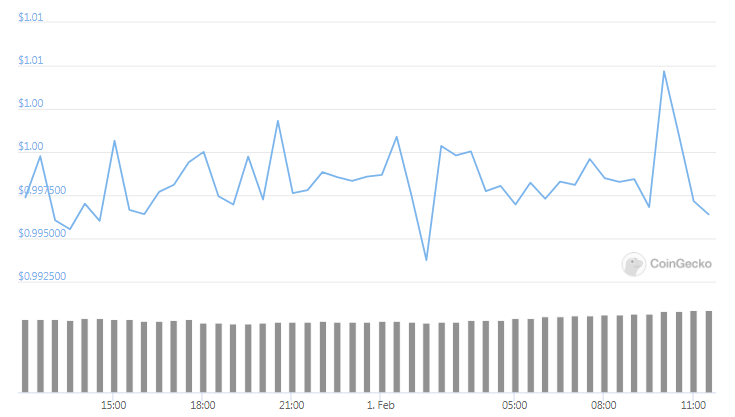

Tether has already dominated the stablecoins markets for the past three years as the treasury continued churning them out with a record level of $27 billion in USDT that is circulating now. The latest data from CoinMetrics shows that Tether’s market share dropped below 75% for the first time ever and the other stabelcoin options are what’s good for the industry in general:

“$USDT market dominance in stablecoins is below 75% for the first time ever

On the other hand, $USDC market dominance has grown to its highest ever level of ~15%https://t.co/ovrTyyEpuf pic.twitter.com/a4v6fNRTch

— CoinMetrics.io (@coinmetrics) January 31, 2021”

The main Tether rival is another centralized stablecoin USDC by Circle. The data shows that its market share climbed to the highest level of 15%. According to the statistics from the company, there are 5.1 billion USDC in circulation but other data even shows it could be higher to 5.9 billion. The integration of CirclePay into Blockfolio’s new trading app will help to boost the USDC adoption as the company claims that USDC is issued by the regulated financial institutions and is backed by fully reserved assets.

Tether on the other hand is under investigation over the audits that could come under pressure if the new Stable Act is passed by the US lawmakers. If the bill is passed, it will require stablecoin issuers to get a new banking license and to submit the audits by the Federal Reserve while also obtaining insurance and store assets at the FED. Since the same time last year, the USDT market cap or supply increased by 520% and is now at 26.77 billion as per the Tether transparency report. Circle’s stablecoin on the other hand surged by 1225% in terms of supply in the past year.

USDC is now eating away from Tether’s market share in 2021 as its usage in DeFi grows. Dai is the third-biggest stablecoin after the two above and also has the advantage of being decentralized and backed by MakerDao. Dai saw some explosive growth in terms of circulating supply in the past year and there are now 1.6 billion Dai circulating which marks a growth of 1400% over the past year. Binance’s BUSD asset is the fourth biggest with a market cap of around 1.4 billion according to CoinGecko. It was launched in September 2019 and has a growth rate increase of around 600%.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post