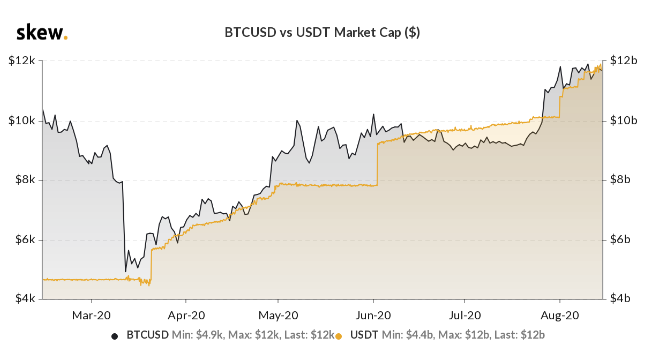

The Tether supply surpassed $12 billion which will make traders more bullish on the BTC price and other cryptocurrencies as we are reading more in the upcoming Tether cryptocurrency news.

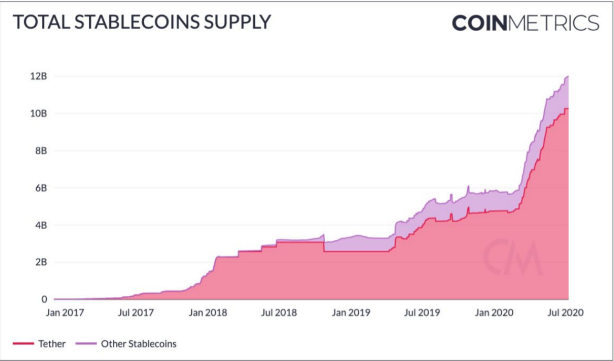

The market cap or the Tether supply surpassed $12 billion according to the crypto market analytics firm Coinmetrics while some still believe that the rising-valuation of the dominant stablecoin benefits only Bitcoin in the long term but some investors fear that it will make the crypto market vulnerable. Tether was the most-widely utilized stablecoin for a few years and it saw some exponential growth as in 2017 the total supply of Tether was hovering at $10 million. In four years, the number increased by 1200 times. Tether is used as a substitute for the fiat currencies on major exchanges including Binance and Bitfinex as the researchers explained:

“Moving into stablecoins allows investors to effectively keep money parked on the sideline without having to completely cash out into fiat currency and incurring fees. This rush to safety likely accounted for a significant portion of the increased stablecoin demand following March 12th.”

Since Tether is used to as hedge against major cryptocurrencies, an argument can be made that the supply represents the capital waiting on the sidelines and while the Tether expands it could show that investors are hedging which leaves an abundant supply of capital that is ready to enter the crypto market. Charles Edwards, the digital asset manager said that the Tether supply could be a catalyst for Bitcoin and said that a 26% increase in Tether is one of the main factors that is boosting BTC upwards:

“How can you be bearish Bitcoin here? – Portnoy in Bitcoin – Fed investigating crypto dollar w MIT – Gold S/R flip – +26% Tether – 45% supply hasn’t moved in >2yrs – Energy Value increasing > price – Mining profitable & price near Production Cost – Accumulation price structure.”

Peter Brandt criticized Tether before, calling it “just another fiat currency”

“The problem is that tether is funny money — a derivative make-believe peddled by the crypto exchanges. As the chart by @Silver_Watchdog shows, total market cap of tether exceeds total cap of cryptos. This is imaginary money backed by air”

The researchers still emphasized that Tether remains dominant and will continue to expand:

“But despite Tether’s issues and the introduction of new stablecoins, USDT remained dominant and continued to grow. Originally launched using the Omni protocol on the Bitcoin blockchain, by the beginning of 2018 Tether began to expand to other networks.”

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post