A report from 2019 shows that Tether settled more than $200 billion worth of coins as we are reading further about John’s Dantoni research in our Tether news.

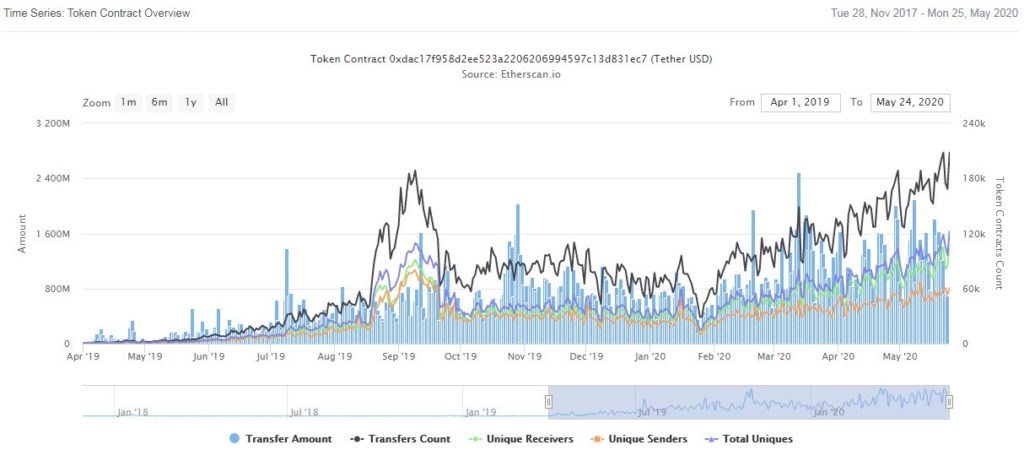

Dantoni examined the total value of transactions that Tether settled back in 2019 and he found that the most substantial increase per quarter was from Q1 2019 to Q2 2019 when Tether’s settlement value reached 220% from $17.4 billion to $55.7 billion. USDT has a dominant market share of 85% and is hosted different platforms such as Tron, Ethereum and Omni. Omni’s dominance declined over the past few quarters and Tron and Ethereum took over the head positions. For example, Tether’s supply on Omni decreased by 14% year to date and the supply for both ETH and TRON grew by 151% and 118% respectively.

USDT fell below the $1 on Friday and stayed below the price point as of press time on Monday according to the latest data from major exchanges such as OkCoin and Kraken which support two of the biggest USDT/USD markets by volume. FTX and Bittrex which will support the trading pair showed a discount on the USDT prices. Over the past two months, Tether LTD issued more than 3.5 billion new tokens which are an average of more than 60 million tethers per day according to Coin Metrics data. However, the tether market capitalization as a proxy for supply since the redeemable for $1 which decreased by $7 million.

The records from Whale Alert suggested that the Tether Treasury printed five batches of new tokens in the past month which reached 480 million USDT which was the same amount that was minted in the first 14 days of April. In the previous report, we showed that Tether minted a whopping 1.58 billion USDT in April alone which makes it one of the busiest months for the company in regards to minting new tokens. Tether’s supply after the newly minted tokens by the Tether Treasury makes more room for the Bitcoin bulls as BTC crossed the critical $9,000 barrier. The data that we have in our bitcoin price news, suggests that the investors are turning to USDT to prepare for another increase in the price in the broader markets.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post