Tether advances in stablecoin liquidity on the Flash lending platform Aave as USDT users locked up more than $7.1 million on the platform. In the latest Tether news, the spike in interest came from the unique possibilities of the flash loan as well as the non-custodial rates on the USDT lending so we are about to read more about this in the following Tether news.

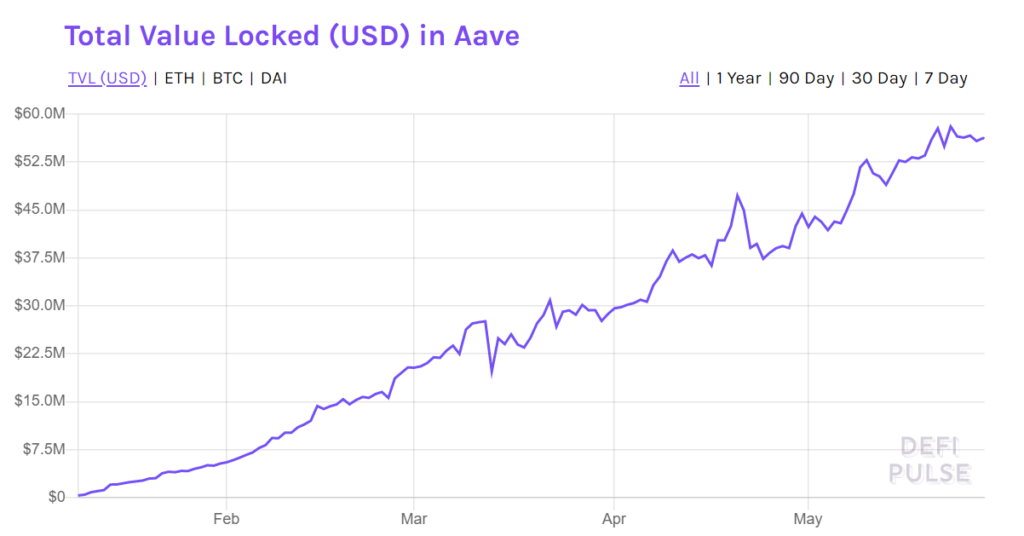

The activity in the DeFi space dropped and reached $1 billion in March, but the flash lending platform Aave continued to see new users. The success of the platform has a lot to do with the inclusion of Tether which is considered the most liquid stablecoin on the market. Since the launch earlier this year, Aave established itself as one of the best new Defi projects mainly because of the new feature called ‘’flash loans.’’

With flash loans on Ethereum Open Finance / DeFi, one can instantly take no risk loans for hundreds of thousands of $’s for arb opps- all in one tx / block.

With traditional CeFi, I can’t even send $100 from my brick and mortar bank to online savings in less than 2-3 days. 🤦♂️

— DCinvestor.eth | aftab.eth (@iamDCinvestor) February 21, 2020

This tool allowed the users to borrow without needing any collateral but only if the loan can be fulfilled in the same transaction. The innovation was exploited previously and suffered major attacks but flash loans are still a unique feature in the crypto space. The platform continued to grow in interest and since the March crash, once Bitcoin dropped by 40 percent, Aave thrived. Right now, Aave has locked about $56 million in the protocol.

The success of the platform can be attributed to the integration of major stablecoins such as TUSD, BUSD. As Tether advances as a liquidity stablecoin, by integrating it into the platform, the success only got bigger. Tether leads the pack with $7.1 million in liquidity thanks to the competitive returns that the users enjoy for lending their assets. The CEO of Aave Stani Kulechov said:

“No other stablecoin has grown at such a pace as USDt in the DeFi lending market space. Since USDt’s launch on Aave, our depositors receive the highest average yield on stablecoins with USDt.”

Looking at the DeFi space, Ethereum-based USDT is now getting to more adopters that look for a more liquid stablecoin. The reports show that stablecoins such as Tether enjoy bigger liquidity on Ethereum as the Tether CTO Paolo Ardoino explained:

“USDt’s growing popularity is making it fast become the stablecoin of choice across DeFi platforms. As the use of USDt grows for myriad purposes the world’s most trusted, stable and liquid stablecoin consolidates its central position in the digital asset ecosystem. Tether is the reserve currency of crypto and DeFi.’’

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post