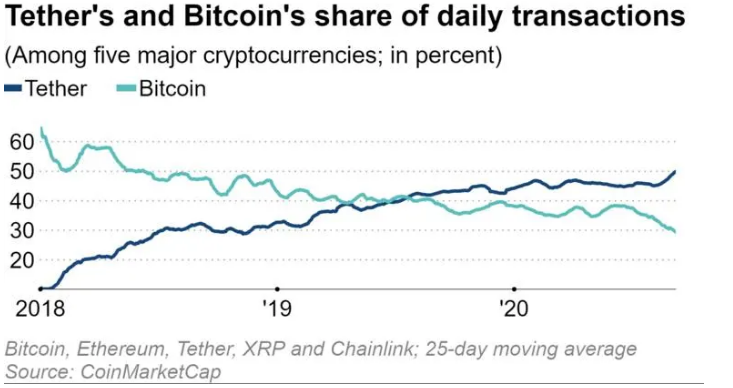

Tether acquires a larger presence on the market than Bitcoin as the use of cryptocurrencies across the world is rising. The flow of crypto assets is not managed by governments or central banks so the authorities are considering stricter rules for crypto in order to prevent money laundering and funding crime. Let’s read more in the following Tether cryptocurrency news.

USDT is an emerging cryptocurrency that was issued by a Hong Kong company, Tether Limited and now Tether acquires a larger presence than Bitcoin. USDT is also a stablecoin which is a newer type of cryptocurrency whose value is fixed against the dollar. One USDT coin has the same value as the dollar so by paying $1 to Tether Limited, a person will receive one coin pegged to the dollar value.

Some wonder whether Tether limited has enough dollars to back up the value of the coins issued but the cryptocurrency transactions are still increasing. Another major issue for the Chinese traders is that traders can trade crypto on the internet without using bank accounts so this means they can smuggle money out of the country. The US Department of Justice announced that they froze crypto accounts of three terrorist organizations one of them which al-Qaeda. This was the biggest seizure of terrorist-linked accounts with more than 300 accounts worth millions of dollars. The Attorney General William Barr said:

“It should not surprise anyone that our enemies use modern technology, social media platforms and cryptocurrency to facilitate their evil and violent agendas.”

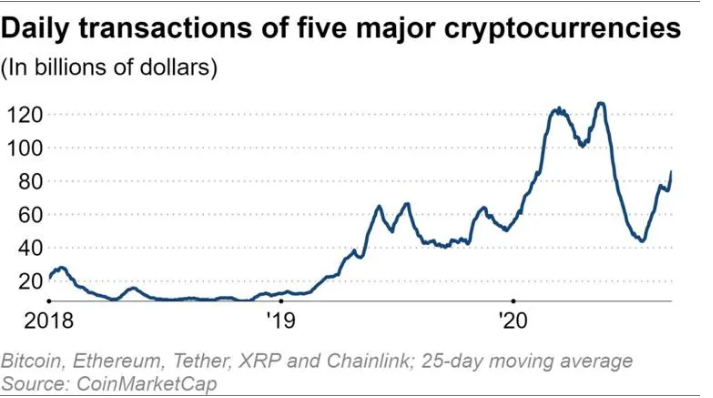

The FATF was mainly concerned about stablecoins such as Tether because their value is backed by assets such as the dollar as they are easier to use when making cross-border transactions. Tether’s average daily transactions between January and August were worth about $40 billion and most of them were conducted in the Thai Baht or Indonesian Rupiah.

Libra, for example, was planned to become a stablecoin so if the 2.4 billion users of Facebook start using it, the impact would be unseen. The rules to regulate cryptocurrencies are decided in individual countries so back in 2019, the FATF recommended introducing rules that will make cryptocurrency flow more transparent. The central bank digital currencies, issued by a central bank, could solve this issue as they are asset-backed currencies that are managed by individual authorities. However, the FATF pointed out that CBDCs also have flaws and they could still be used for unlawful purposes.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post