The market cap of Tether hit $11 billion recently, marking a growth of 136% since the year started as we are reading more in our tether news today.

The record BTC and UST inflows pushed the market cap nearly half a billion dollars up to get more traffic and the market cap of Tether broke past the $11 billion levels as the demand for stabelcoins is up for both hedge for volatility and crypto on-ramp. As a burgeoning crypto custodian industry, it will only boost the demand for stablecoins as Binance reported, saying they are a favorite of institutional investors.

Tether Market Cap Crossed $11B

The market cap of leading stablecoin #Tether has surpassed $11B and it's now $11.18B.

This development represents a a growth of 136% from the beginning of 2020.

👉https://t.co/DPGQMz6xMX pic.twitter.com/ePFWYMJtZP

— CryptoRank Platfrom (@CryptoRank_io) August 4, 2020

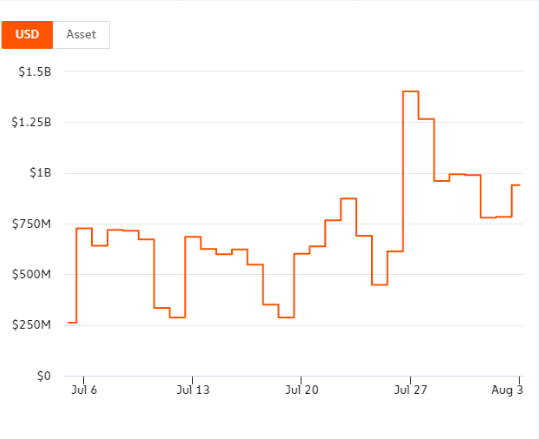

As the demand for stablecoins continues to rise, the market cap of Tether hit $11 billion, marking a 136% since the start of the year. USDT/BTC is one of the most liquid crypto pairs and the cheapest way to get your hands on Bitcoin. The BTC inflows are all up across all exchanges according to Chanalysis but down during the past weeks as the markets corrected. Stablecoins which are tied to a fiat currency like the US dollar is used as on-ramps and off-ramps for crypto transactions.

If investors would like to purchase a token they can purchase the stablecoin first which isn’t as volatile as a cryptocurrency and will have a minimal margin on the conversion. Also, if investors would like to sell one token for fiat currency but not cash on the market itself, stablecoins serve as an off-ramp to move capital out of the market. Over the past year, the total supply of the stablecoins doubled to about 12 billion as investors were spooked by the March crash and crypto looked quite safe according to a research company Coin Metrics. For a point of comparison, it took about 5 years for supply to reach 6 billion.

According to a report, more than 800 million new USDT was issued within two weeks of the March crash. Just as a comparison, 740 million USDT were issued from January 1st to March 11th. According to the data from Crypto Compare, the traders purchased 21 million bTC with USDT during the March crash which means it reached 73% of total btC traded into fiat.

One of the biggest stories this year was the rise of the digital asset custody industry which is a key requirement for institutional investors on the market. Hong Kong was the first market with a regulatory framework to get on the market but US regulators announced that they will greenlight US banks to act as crypto custodians.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post