The king of stablecoins, Tether, despite being widely used, could face heavy regulatory uncertainty as governments step up their regulatory scrutiny according to new reports that we have in our Tether news.

According to CoinMetrics, the king of stablecoins, USDT came under increasing scrutiny from regulators this year. This was stepped up last week when the International Financial Action Task Force said that the stablecoins will have to comply with relevant standards in order to prevent money laundering and terrorist financing. According to Coin Metrics, the increase in regulatory scrutiny could mean that everything from exchanges to over-the-counter desks and stabelcoin issuers will have to implement know-your-customer measures to stay compliant.

A new global focus on compliance with regulators across the world puts a damper on the OTC desks and arbitrage activity which contributed to Tether’s supply growth as Coin Metrics warned, adding that this could bring benefits to stablecoin such as Coinbase’s USDCoin and Facebook’s Liba. Stablecoin will further mature along with the crypto market. Stablecoins are candidates for large-scale use of assets in places such as international payments and remittances.

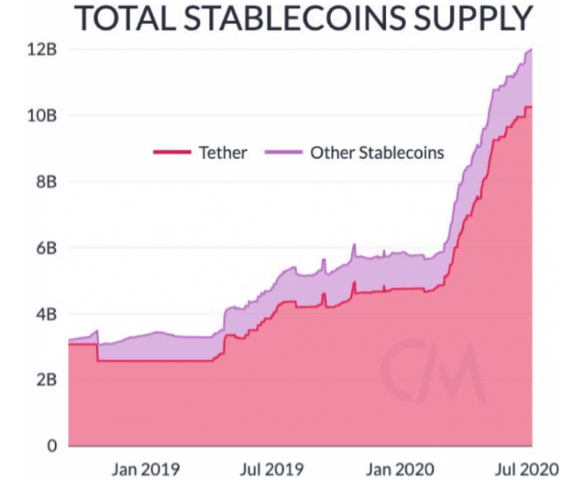

As reported, the stablecoin supply skyrocketed in 2020 and the reasons are not known yet but the March crash played a huge role in the supply increase as the traders rushed to get their hands on stablecoins because they are deemed safer. The report noted:

“Within two weeks of the crash over 800m new USDT_ETH were issued.”

We can also see from the report that it took more than two months for 740 million in Tether to be printed at the start of the year. The entire landscape is dominated by Tether after the Black Thursday:

“The supply of other stablecoins rose as well, but by no more than a few hundred million. Tether, once again, led the way by a large margin.”

Tether is designed as a blockchain-based cryptocurrency that has its digital coins in circulation backed by the same value of fiat currencies such as the US dollar, the Euro, or the Japanese Yen. A few weeks ago, the reports showed that the momentum with the help of the US dollar was supposed to make the cryptocurrency gain and move in the second spot. With the absence of reversal in the crypto trends, it should be a matter of time until Tether passes Ethereum to take the second position in total assets behind Bitcoin.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post