One CoinMetrics research analyst believes that Tether can see its use-cases diversify shortly as it is now in the perfect position to do so. The crypto ecosystem has evolved dramatically over the past ten years while Bitcoin still being the most recognizable asset. The industry’s adoption rates look different and Tether was the considered stablecoin that will only improve the entire ecosystem, so let’s find out more in the Tether coin news.

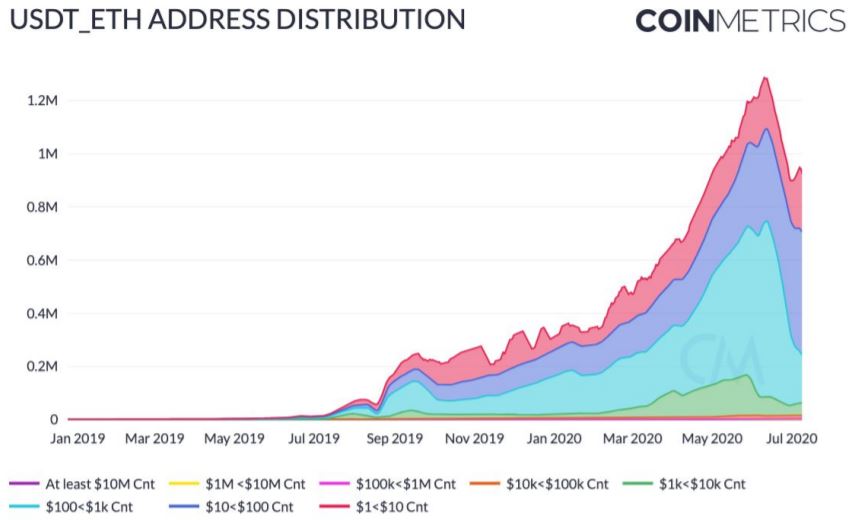

With stablecoins growing in popularity, the distribution of Tether sheds further light on the direction of the stablecoin market. Nate Maddrey, the CoinMetrics research analyst outlined the changing dynamics with respect to the accounts that own significant portions of stablecoins such as USDT as Maddrey noted:

“This shows that over 4 billion Tether right now is held by addresses that hold at least a million dollars worth of Tether. So basically whale addresses hold a large majority of the overall Tether supply and this suggests to me that most Tether is being held on exchanges right now.”

Earlier this year, Bitcoin’s price dropped by half in less than an hour during the infamous Black Thursday as stablecoins saw their premiums increasing. According to Maddrey, more addresses stored money on exchanges in stablecoin form and while they are holding huge amounts of USDT noted an increase in the past few months there has been a similar increase at the other end of the spectrum as well:

“There was an explosion in smaller addresses too, following March 12. So we kind of saw two things happening at once.

buy ivermectin UK https://nouvita.co.uk/wp-content/languages/new/ivermectin.html no prescription

We saw a large growth in small addresses, holding a thousand dollars or less worth of Tether. And we also saw a large growth in the supply held by whale addresses.”

According to the CoinMetrics research analyst, there was an increase in addresses with $1K or less but the trend was reversed over the past two months:

“There are over 750K USDT_ETH addresses that hold at least $10, and about 325K that hold at least $100. But there are less than 55K addressees that hold at least $1K worth of USDT_ETH, which means a large majority of addresses hold relatively small amounts.”

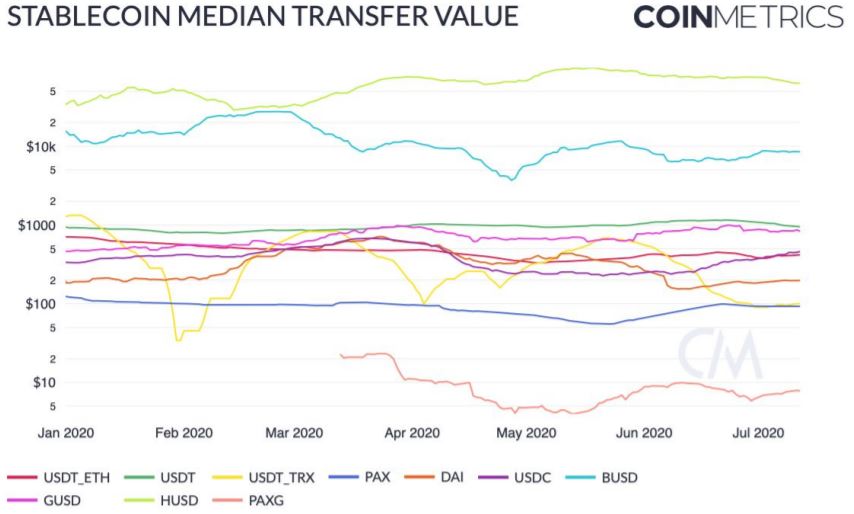

Maddrey went on to note that Tether’s USDT remained cheaper to trade because of the higher liquidity and pointed out that the increase in addresses which can be a sign that people are now preparing to use stablecoins as a medium of exchange and not only to store the funds on exchanges.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post