Stellar Lumens surged 12% after the latest Moneygram partnership announcement to use the USDC on the Stellar blockchain for faster and cheaper transactions so let’s read more in our Stellar news today.

Moneygram is dipping its toes into the blockchain space as the company just announced a new partnership with the Stellar Foundation to develop a payments bridge that streamlines money transfers and enables fast settlement in USDC. The announcement was released a few hours ago and it outlines the innovative vision Moneygram has assuring that the partnership will revolutionize the settlement flows.

As explained in the Press release, Moneygram will use the USDC stablecoin pegged to the US dollar on the Stellar blockchain as a means to make transactions much more efficient. United Texas Bank will serve as the settlement bank between Circle and Moneygram. This will be the second attempt Moneygram did to leverage blockchain and improve its services. Stellar is a direct competitor to Ripple that was created by Jed McCaleb who co-founded Ripple and then parted ways with the company due to conceptual differences.

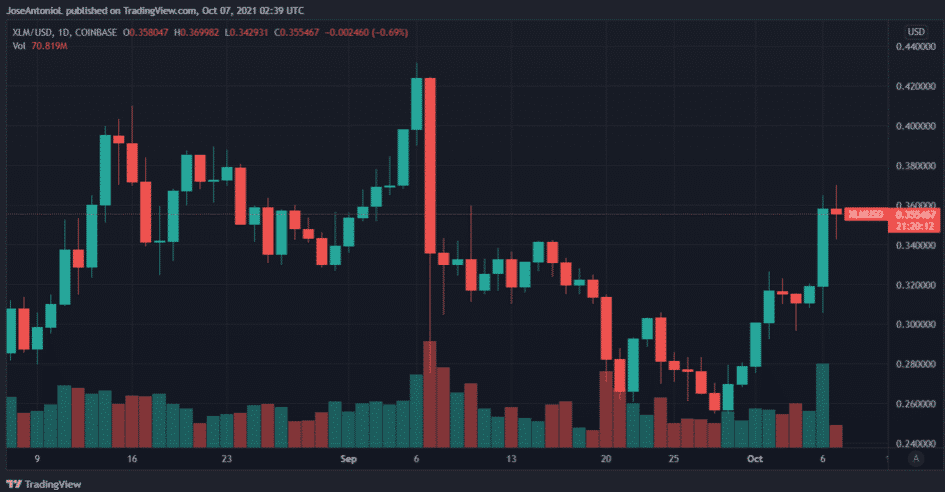

Stellar Lumens surged 12% as it closed the day with a 12% rise that was also fueled by Bitcoin’s traditionary performance during the day. XLM Opened the day at $0.31 and closed it at $0.357. Moneygram shares, on the other hand, were more conservative. The company was not able to stop the free fall from the yearly high set in July and posted 0.

buy vidalista online www.mydentalplace.com/wp-content/themes/twentytwelve/inc/en/vidalista.html no prescription

9% growth going from $7.6 to $7.69 with no trend reversals. The partnership is a clear signal that Moneygram aims to go ahead and get rid of the bad experiences that it had with Ripple.

Moneygram and Ripple announced a partnership two years ago and the payment service aimed to use RippleNet as a part of the exchange settlements process for international remittances while also receiving financial incentives in the form of XRP but in exchange to give Ripple an equity stake in the company. The partnership lasted two years and ended in 2021 in March when the SEC initiated a legal proceeding against Ripple accusing it of using XRP as a way to issue unregistered securities. Ripple assured that the decision to split was a joint one but both parties could revisit their relationship if the SEC dispute ends:

“We are proud of the work we were able to accomplish in a short amount of time, as well as the impact we were able to achieve in bringing this first-of-its-kind product to market. Together, we processed billions of dollars through RippleNet and On-Demand Liquidity (ODL).”

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post