XRP swells 40% despite all the delistings from major exchanges and became one of the few best performers in the crypto space shortly after so let’s take a closer look at the Ripple price news.

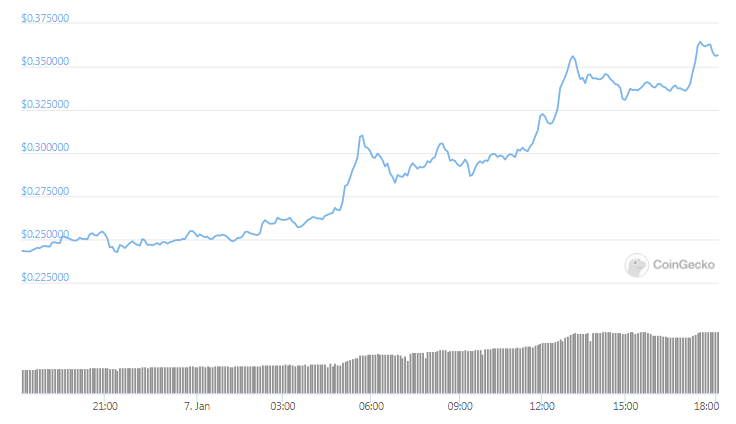

The XRP/USD exchange rate increased by about 40% on the 24-hour adjusted timeframe which means it hit an intraday high of $0.328. Measured from the bottom of the $0.17 level from December 30, the pair was trading about 94% higher which signaled a slight pullback after the 82% crash from the peak at $0.92. The gains appeared in the wake of the market rally with traders raising their bids on all top-cap coins and BTC hitting $37K. Altcoins usually do better when BTC tops out which partially explains why XRP swells 40%.

$XRP needs to crack this significant resistance zone to be able to continue the upward push.

If that doesn't occur, more consolidation is required.

Full analysis:https://t.co/VnjR2q012a pic.twitter.com/xKcQSNtnNZ

— Michaël van de Poppe (@CryptoMichNL) January 7, 2021

In the meantime, Ripple signed a deal with Saudi Arabia’s central bank in order to innovate their payment infrastructure with blockchain solutions. The news made XRP increase in price especially now because the plans involve expanding outside of the US after the lawsuit from the Securities and Exchange Commission. The court battle prompted crypto brokers exchanges to drop support for XRP on their platforms including Blockchain.com, grayscale Investments, Coinbase, OKCoin, Bitstamp, Binance, and more.

However, a group of XRP investors sued the SEC Chairman Jay Clayton for being personally hostile over his enforcement action against Ripple. XRP’s rise despite its bearish bias, raised concerns about a rebound as one analyst tweeted that he saw the pair pullback as a “dead cat bounce” which is a brief recovery in the price of a declining asset. He continued:

“XRP at strong horizontal support, but even if it holds the upside in buying here is minimal. It took years for it to move, and it could be years for it to recover. There are much better assets to trade, in my opinion. The odds of $0.50 to $1.00 are even lower than before.”

In the meantime, Michael Van De Poppe stated that the XRP/USD pair will have to overcome the $0.31 levels in order to confirm the bullish bias. Until this happens, the pair’s chances of stronger increases are slim and more sell-offs look poised to happen.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post