XRP nears “death Cross” which usually marks a major price bottom as history shows but the coin can find support near $0.51 as we can see more in our latest ripple news.

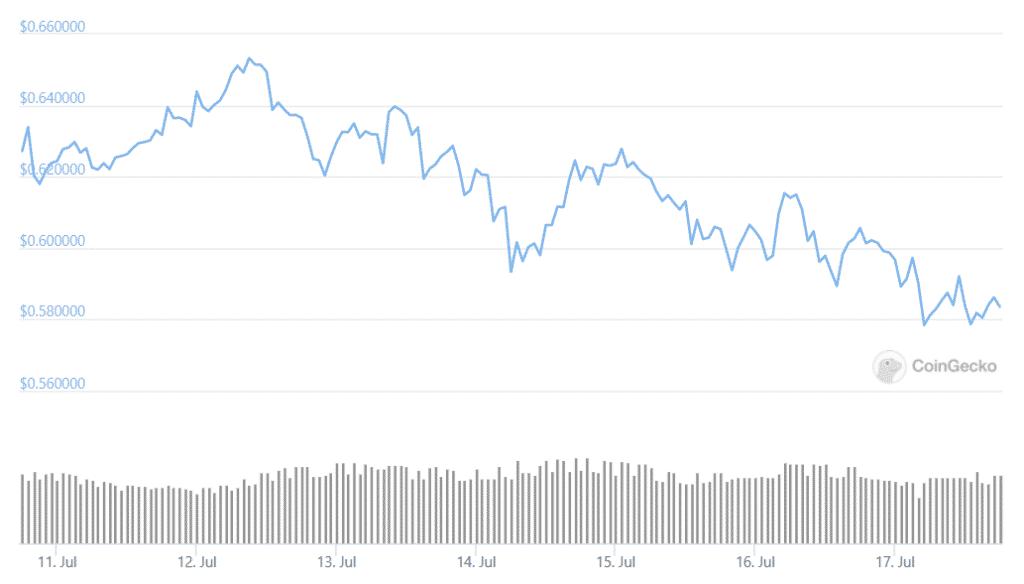

XRP’s price chart seems ready to paint the first “death cross” in five months which is a signal analysts consider to be a bear market indicator. As XRP Nears “Death cross” the 50-day simple moving average of the coin’s price is expected to cross below the 200-day SMA in the next day or two which only confirmed the so-called bearish death cross. While in theory, the pattern usually shows a much bigger sell-off, the data suggests otherwise.

Previous occurrences were seen in February this year, March 2020, and August 2019 as well as earlier than that, marked a major or interim price bottom with the one in 2014 creating immediate selling pressure to the market. Death Cross’s dismal record as a reliable indicator is not surprising as the moving-average studies are based on backward-looking data but in other words, death crosses are usually a result of a prolonged sell-off and have limited predictive powers. The market is more often than not in the oversold territory by the time the crossover happens. The previous bearish crossover was accompanied by an oversold or below 30 RSI levels.

As recently reported, Ripple Labs’ legal representative James K. Filan, said on Twitter that the company filed an opposition to the US Securities and Exchange Commission request for a two-month discovery deadline extension. In the lawsuit against Ripple, the SEC requested to prolong the discovery phase that will delay the legal process and jeopardizes the company’s ability to continue operating in the US. The US SEC Filed an official request with Judge Analisa Torres for a fact and expert discovery deadline extension of 60 days.

The SEC’s two-and-a-half-long investigation that came before the lawsuit against Ripple gave the regulators a head start in the case but the defense said that this is not a good reason for an objection to the deadline extension request. The defense admitted that the company’s wishes to go ahead for summary judgment as soon as possible are clear because the litigation poses a threat to Ripple’s ability to continue operating in the US but also said that this is not an arbitrary preference for speed.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post