According to a crypto analyst, XRP is wildly overpriced despite the recent 90% crash which made the asset the worst-performing one for 2020. Since 2018, XRP entered in a state of consistent macro downtrend even when Bitcoin and other assets skyrocketed. Ripple’s priced has only traded lower and lower with no bottom to speak of so let’s find out more in the following Ripple XRP price news.

XRP remains 90% below the all-time high as of the time of writing despite the recent rally from the March lows. Despite the traumatic macro performance, one crypto trader believes that XRP is wildly overpriced and that the asset is not done bleeding out:

“Call me crazy but I don’t think XRP will ever break $1.00 again, much less $3.00. Even at 23 cents, it’s wildly overpriced.”

The trader asserted what the other traders believe in recent weeks. While the cryptocurrency has a promising technology, there’s no guarantee that the technology itself will result in XRP reaching more gains that will be the same as those in 2017. The analyst wrote:

“Here are just a few of the hundreds of 10-year charts you can find for ‘promising tech’. See a similarity? Many of these same charts have forums of people still talking about the recovery to come.”

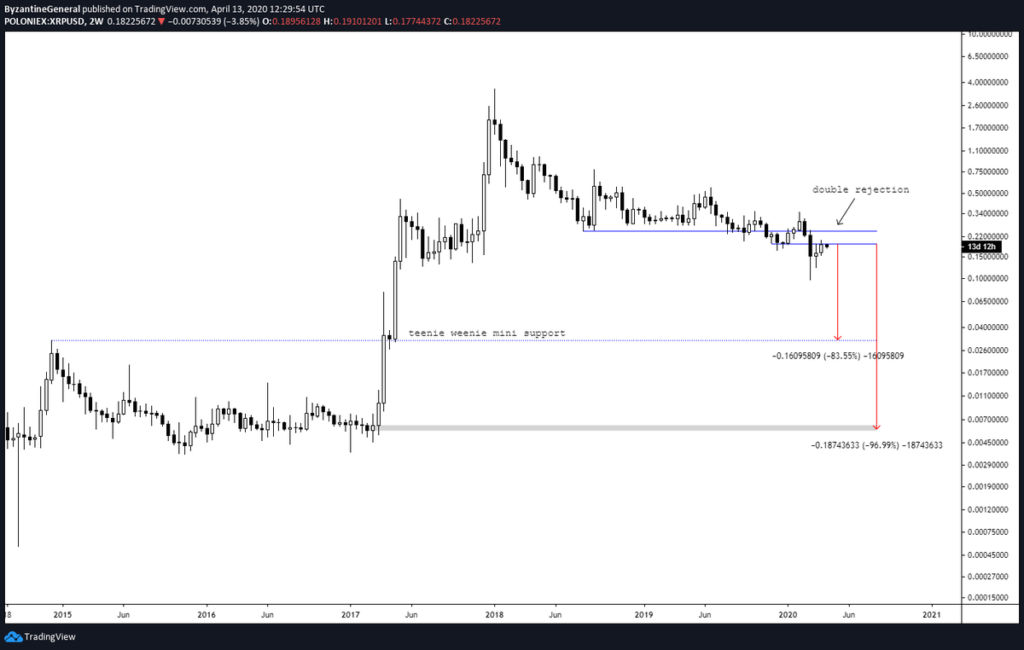

In terms of technicals, the analyst warned that the macro chart of the cryptocurrency is one of the ‘’scariest charts’’ there is, because of the lack of historical liquidity on the downside which shows how XRP was rejecting the key horizontal. Peter Brandt explained that the long-term charts for Ripple are quite bearish because there is only ‘’white space below’’ the price which almost no historical support or liquidity. He didn’t predict more for XRP but many took his statement as a sign that the cryptocurrency will fall to a price level in the single-digit regions and even lower.

While it may seem that XRP is getting singled out, the growing sentiment in the crypto trading community is that the altcoins all have the tendency to underperform. Another analyst that works for the research company Blockfyre shared that he is reducing the exposure to altcoins because he believes Bitcoin’s block reward reduction will cause even more volatility on the markets. The analyst continued explaining how the altcoins are always ‘’game of musical chairs’’ since the reasons they are rallying are all red flags:

“The reason the alt pumps are unconvincing is that they have followed the same patterns. IEO’s, Interoperability, privacy coins moving together. It’s coordinated as it has been the last 3 years instead of all ships rising together.”

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post