The XRP price can drop by 30% in March due to a combination of technical, fundamental, and social sentiment indicators that are threatening the price of Ripple’s native token as we can see more in today’s latest Ripple news.

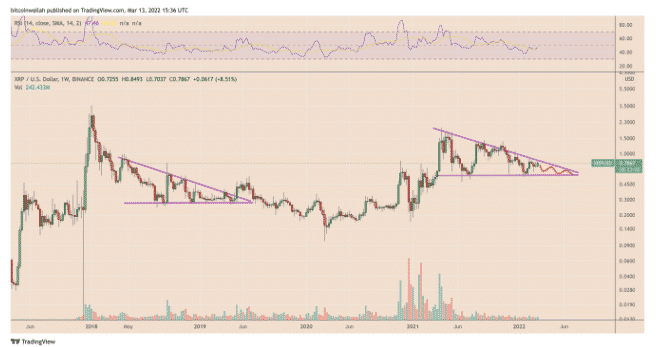

Ripple’s XRP price risks dropping by more than 25% in the upcoming weeks due to a multi-month bearish setup and more fears about the excessive XRP supply. XRP has been consolidating inside a descending triangle pattern after topping out to a second-highest level to date near the $1.98 since 2021. By doing so, the XRP/USD pair left behind a sequence of lower highs on the upper trendline and found a solid support level near $0.55.

Just over the weekend, XRP’s price tested the triangle upper trendline as a resistance which raised alarms that the coin can undergo another pullback move to the support pattern trendline near $0.55 and amounted to a drop between 25% and 30%. the downside outlook takes cues from the bearish catalysts that emerged around the triangle resistance so for example, XRP formed a bearish hammer during March 12 and a single candlestick pattern with a smaller body which suggests lower buying pressure near the coin’s week to date top of $0.85.

The price turned lower and tested a confluence of resistances defined by the 20-week exponential moving average and the 50-week EMA. The downside cues for XPR came when Ripple Labs locked 800 million XRP in escrow as a part of the programmed schedule for a withdrawal. The blockchain payment company moved near the 100 million XRP worth $40 million at the start of March and in the meantime, it kept the other 700 million coins in escrow accounts and raised the anticipations that are at least 200 million XRP which will be flooded into the market and generate funds for Ripple’s operational expenses and the distribution of XRP among Ripple’s clientele.

The selloff fears stemmed from the XRP price’s response to the sudden hikes in supply. For example, XRP/USD dropped by mroe than 50% to near $0.60 four months after the net supply in circulation increased to over 47 billion in only two days from the previous 40.46 billion. Ripple’s withdrawal of 800 million XRP hasn’t been reflected in the net circulating supply.

Another major catalyst for the XRP price can spike a 30% drop and it is the Santiment indicator that tracks social media trends and the impact on market trends. XRP’s price increased by over 15% week to date alongside a large spike in social media searches for the hashtag #XRPNetwork which suggests it could follow up with a new selloff ahead:

“Historically, our social trends indicate that profit-taking is justified whenever the crowd makes the #XRPNetwork a top topic.”

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post