The SBI plans to use the ripple payments network for ATM access in Japan which will make it easier for the people to get faster access. SBI Holdings is a partner of Ripple and now aims to use its technology as we are reading in the ripple price news.

In the latest financial results report, the financial services company stated it will be working to integrate the Ripple-powered settlements app MoneyTap with the ATMs that are run by different banks across the country. This move could make it easier for users to access their funds at any ATM no matter the affiliation of the bank. SBI says that the project could improve the bottom line for the banks themselves by cutting down on operating costs:

“Currently, each bank has an ATM with its own bank app, but with a common web app, the same ATM may be used as its own jointly operated multi-bank ATM.”

SBI aims to launch the MoneyTap banking consortium that is led by SBI Ripple Asia. This consortium has 61 banks that represent about 80% of the banking assets in Japan. In September last year, the SBI holdings’ president Yoshitaka Kitao was quoted saying that the new app is fully licensed by the Japanese regulators and they will utilize the native cryptocurrency of ripple in the future. The company, however, has yet to officially confirm the plans to integrate the digital assets into the app.

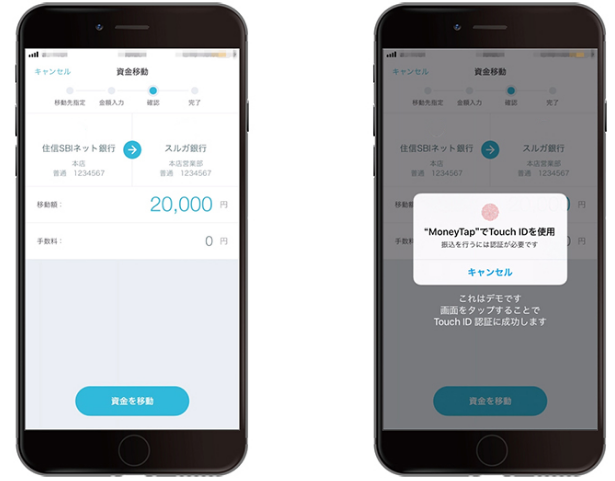

SBI plans to use MoneyTap which was launched in October 2019 which allows people to send and receive money instantly by using phone numbers or QR Codes. The app is now available on both iOS and Android.

In the recent Ripple price news, Ripple remains strong above the $0.1900 level against the US dollar but it has to yet surpass the $0.2000 and $0.2050 resistance in order to gain bullish momentum in the near term. The price is facing a few key resistances at $0.2000 and $0.2050. There was a recent break above the key bearish trend line with a resistance of $0.1975 on the hourly charts of the XRP/USD pair. Ripple will also launch a loan platform and has already opened payment services in Kuwait. All of this is part of the partnership that the cryptocurrency project has with the Kuwait Financial House (KFH) that allows for the launch of payment services to Turkey.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post