Ripple’s Q2 reports show a 50% rise in the sold XRP coins compared to the $273 million sold in the first quarter so let’s have a closer look at today’s latest Ripple news.

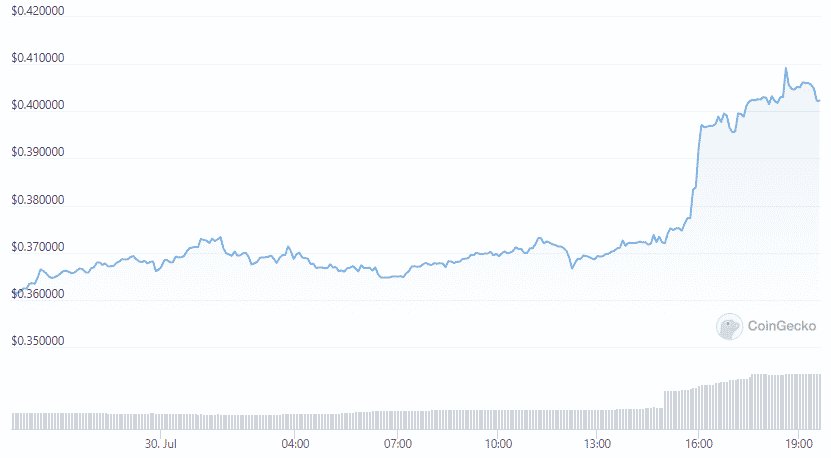

The blockchain company Ripple announced that it had a successful second quarter in 2022 since it made multiple strategic partnerships and expanded the use of the on-demand liquditiy as the company sold $408 million worth of XRP compared to the $273.27 million in the first quarter. Ripple’s Q2 reports show that there were some issues in the crypto market but in the past few months, projects like Celsius, Three Arrows Capital, and Terra collapsed which caused even further uncertainty and investor outflow.

Despite the adverse events, Ripple’s performance in the second quarter was successful and in May, the organization even shook hands with the Lithuanian FINCI to provide retail remittances and business to busienss settlements via on-demand Liqudity. A few days ago, the company made another partnership with the Signaporeanfinech company FOMO Pay which will utilize Ripple’s ODL technology and achieve low cost and swift cross-border payments in the US dollar and the EUR. It is worth observing how the entity managed the native token holdings during the second quarter of the year and it even parted with $408.9 million worth of coins which is more than the $273 million sold in the first quarter.

Ripple continued to support the green environment policies by committing $100 million to accelerate carbon removal activities and this financing will support the developer tools that enable carbon credit tokenization like NFTs. Last month, Brad Garlinghose as the Chief Executive Officer of the company predicted that the crypto winter will not be lost for that long:

“If you recently joined the industry and haven’t seen a downturn like this, know that this too shall pass (advice from someone who’s seen a few downturns over the years).”

To prove a point, he outlined preivous bear markets which reigned over the past year like the Dot com bubble and the 2018 digital asset winter. Prominent companies like Booking, eBay, and Amazon survived the crash and now stand as the main companies in their fields.

buy levitra oral jelly online www.adentalcare.com/wp-content/themes/medicare/editor-buttons/images/en/levitra-oral-jelly.html no prescription

For its part, BTC overcame the turbulences and reached a peak level in 2021.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post