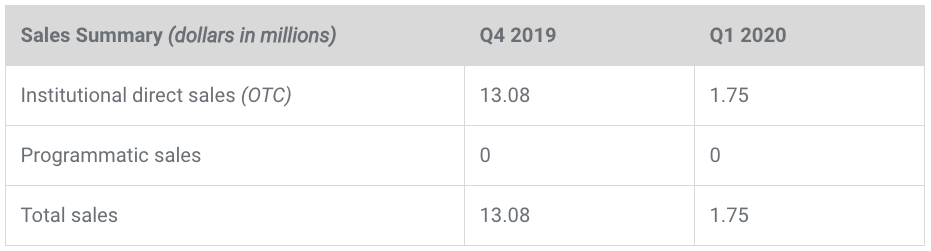

Ripple recorded its lowest quarterly XRP sales yet by only selling a total of $1.75 million worth of coins which is down from the previous $13.08 million. In our Ripple XRP news today, we take a closer look at the Q1 analysis.

The 87% drop in sales is consistent with the move of the company to a conservative sales benchmark. The latest XRP markets report shows that Ripple recorded its lowest XRP sales over the last quarter. Over the first quarter of this year, Ripple only sold about $1.75 million worth of XRP which represents an 87% drop in sales compared to the previous quarter where the company sold about $13.8 million worth of coins.

Unlike the other quarters, the sales came from the institutional over-the-counter and these efforts were mostly concentrated in Europe, Africa, Asia, and the Middle East which were considered as strategic regions. The company stopped the programmatic sales which mean they will no longer sell XRP directly on the exchanges. Turning to conservative volume benchmark for XRP sales started back in the second quarter of 2019.

According to the report, the on-demand liquidity of Ripple tripled in transaction volume from Q4 2019 to Q1 2020 when the dollar value transacted over the platform increased by three times. One of the things that can be contributed to the increase in volume was the partnership between Ripple and Azimo which is a UK-based digital money transfer system. Azimo partnered with Ripple to send payments to the Philippines and even saved between 30-50% in only a few months of arranging transfers.

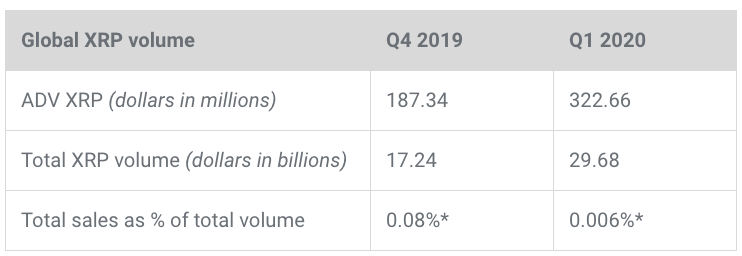

Aside from the new partnership with Azimo, the volume increase that the company saw happened mainly because of the XRP getting integrated into a bunch of additional crypto exchanges and other liquidity instruments in the past quarter. The data shows that the XRP daily volume increased dramatically compared to the previous two quarters increasing by more than 60% when it was compared to the fourth and third quarters of 2019. The coin even surpassed Bitcoin in volatility but still stays behind Ethereum which saw its volatility levels and returns of 5% and 7% respectively. This volatility can be a result of the major rally when XRP was up by 11 percent over the past week.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post