Ripple fired back on the latest SEC developments, saying that the regulator is to blame for harming innocent XRP holders as we can see more in today’s Ripple news.

The Ripple team released a new statement in response to the events of the past week, saying that they are innocent and they are falsely charged by the US Securities and Exchange Commission. Ripple fired back adding that the “muddied waters” affected innocent XRP holders that claim have no real connection to Ripple. What’s more to it, the company accuses the SEC of acting against their own manifesto by pursuing the case:

“their lawsuit has already affected countless innocent XRP retail holders with no connection to Ripple. It has also needlessly muddied the waters for exchanges, market makers and traders. The SEC has introduced more uncertainty into the market, actively harming the community they’re supposed to protect. It’s no surprise that some market participants are reacting conservatively as a result.”

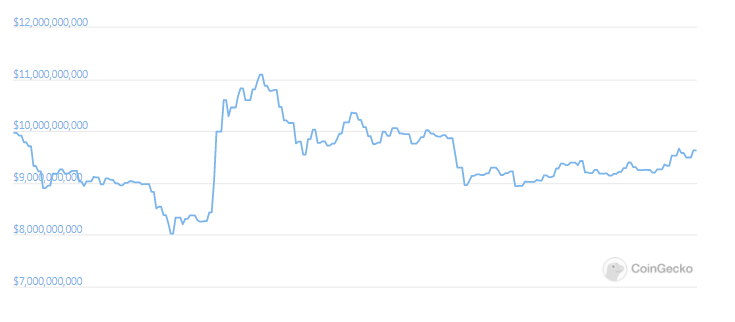

The statement was not enough to stop XRP’s price from falling further. The bears are dominant but the $0.17 support level didn’t hold and lead to another daily close above the level of $0.22. The mounting selling pressure saw a continuation today with the price trading down by 7% to $0.20301. The announcement by Coinbase that will stop XRP trading was a huge blow for ripple as the company said:

“We will continue to monitor legal developments related to XRP and update our customers as more information becomes available.”

Bittrex also announced today that they will also be suspending XRP Trading and will remove all four available pairs on the platform as of January 15, 2021. Similar to Coinbase, wallet transfers will remain functional. Both of these exchanges drew a lot of criticism because the global suspension makes no sense as the SEC has no jurisdiction over the non-US customers. However, exchanges are being cautious and they want to avoid any legal repercussions during the period of uncertainty.

A pre-trial conference to hear the Ripple securities fraud case is set for February 22, 2021:

“A pretrial conference may be conducted for several reasons: (1) expedite disposition of the case, (2) help the court establish managerial control over the case, (3) discourage wasteful pretrial activities, (4) improve the quality of the trial with thorough preparation, and (5) facilitate a settlement of the case.“

Brad Garlinghouse said previously on the SEC developments that he wants the opportunity to clear his name and his company’s name and upholds the view that this is necessary to defend the entire industry.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post