The Ripple CTO considers that is time to sell some crypto while the native XRP coin is hitting a year-to-date high of $1.81 so let’s read more in our latest Ripple news today.

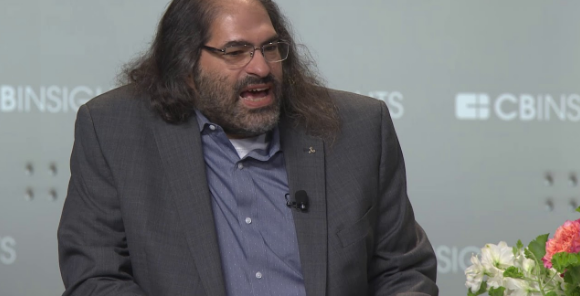

The Ripple Labs CTO considers that these are life-changing amounts of crypto that should be taken into consideration. XRP is fighting a $1.3 billion SEC lawsuit over whether XRO is a security or not. David Schwartz is giving some reasonably sound advice when it comes to investments though it comes at a strange time for the payment network.

“If you have life-changing amounts of cryptocurrency, please take some time to seriously consider selling some to reduce your risk and exposure. This is not any kind of prediction about what the market will do.”

This is probably going to be my least popular tweet ever, but: If you have life-changing amounts of cryptocurrency, please take some time to seriously consider selling some to reduce your risk and exposure. This is not any kind of prediction about what the market will do.

— 𝘋𝘢𝘷𝘪𝘥 "𝘑𝘰𝘦𝘭𝘒𝘢𝘵𝘻" 𝘚𝘤𝘩𝘸𝘢𝘳𝘵𝘻 (@JoelKatz) April 13, 2021

He went on to say that the holders should reevaluate whether they have about six months of earnings in crypto or “significant debt.” Given the current state of the market, Ripple increased 850% in the past year while Bitcoin is up 790% to $63,000 which is probably for the most long-term holders. Schwartz took his own advice in the past as he admitted back in 2019 to have sold $40K worth of ETH before the peak in 2017 to buy solar panels.

He suggested:

“I guess I was thinking it would go back down and I’d buy back in. But it didn’t. You can regret taking too little risk too, of course.”

Schwartz’s tweet seems hardly controversial. When a risky investment in a volatile asset pays off, it’s best to convert some of the profits into something more stable. That is why retirement mutual funds rebalance every year to increase the percentage of bonds that are relative to stocks and locks in earnings. The tweets come during the middle of a $1.3 billion SEC lawsuit against Ripple Labs over what the agency sees as unregistered securities sales of the XRP token. That case hinges on whether XRP is an investment contract or a virtual currency.

Ripple filed a motion to dismiss the SEC’s suit after the tech company won three decisions. Second, Ripple can redact some of the private email exchanges and will limit what the SEC can use as a weapon. The SEC’s request for executives’ personal financial data was denied. The case however isn’t over yet. The company executives tried to maintain a low profile in a legal proceeding.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post