Ripple continues flooding the market, putting a number of tokens into circulation and now the XRP prices could soon suffer the consequences as we are reading in our latest XRP news.

Ripple’s over-the-counter sales of XRP made a staggering rise of over 1760% in Q2 2020 and many investors seemed concerned about the huge increase in the total number of circulating tokens. The spike in the selling pressure behind XRP could see it pullback towards $0.28 or even $0.24 as Ripple revealed that it ramped up the XRP sales last quarter which could lead to a major correction based on the different fundamental metrics.

Ripple continues making headlines after revealing that it still floods the market with more XRP coins. the US-based company reduced the sales of its tokens in Q1 but this seems to be changing. Ripple sold about $32.6 million coins to institutional investors in the second quarter hence the 1760% increase. According to Ripple, the spike in sales is mainly because of the growing adoption that the cross-border remittances token experienced and the integration into different markets as well. The report reads:

“The development of liquid and robust markets is key to the success of ODL. The second quarter of 2020 saw numerous integrations that helped contribute to the health of XRP markets.”

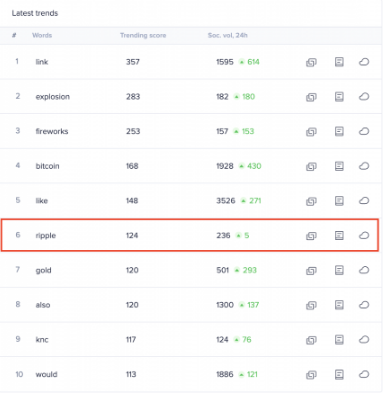

After the release of the report, the number of XRP-related mentions exploded on social media and this allowed the coin to move to the number six position on Santiment’s emerging trends list. When market participants pay a lot of attention to a cryptocurrency it will lead to a steep correction, as the head of content at Santiment Dino Ibisbegovic said:

“On average, the moment [cryptocurrencies] show up on the list, the dump begins. In the second week since appearing on the Emerging Trends list, the coins we backtested have, on average, lost a massive 8% of their total price. And this is on a sample of 200 coins.”

The TD Sequential indicator added credence to this bearish outlook as it presented a sell signal in the form of a green nine candlestick on both 1day and 12-hour charts. The bearish sentiment shows that the cryptocurrency is bound for a one to four daily candlesticks correction before another uptrend emerges. The recent TD Setup was not accurate entirely as it still holds a lot of credibilities. For example, back in May, it presented a sell signal that led to a 20% drop so the current pessimistic outlook has to be taken seriously.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post