Ripple believes that the United States will lose the technology war with China if the regulators don’t create clear laws in the crypto sector as we reading more in the upcoming Ripple XRP news.

Ripple encourages the governments across the world to create better regulations in the crypto sector as the company criticized the lack of legal framework, negligence in determining which assets are securities and the regulatory ambiguity. In a recent publication, the General Counsel of the payment solution company Stu Alderoty, criticized the US position towards the entire crypto industry. He raised one of the main issues for the industry in the US which is the lack of clear legal framework.

Ripple’s General Counsel said that the work that some US authorities did for the good of their consumers such as the Office of the Comptroller of the currency is one of the few things that are taken into consideration. The entity allowed the banks to hold on cryptocurrencies which were seen as a huge step towards their adoption. However, Alderoty said that the United States has been negligent in terms of regulation as there are no predictable scenarios that allow a company to know what the consequences of the actions will be if they use crypto, and this is an innovation killer.

In that regard, Ripple believes that the US will lose the technology war with China as Alderoty criticized the Securities and Exchange Commission for not giving clear answers on which assets are considered securities. With the exception of ETH and BTC which are already classified as commodities, the regulator has an ambiguous policy for the rest:

“ The answer to that question matters significantly. Complex and burdensome securities regulations, when incorrectly applied, smother industry innovation. Imagine imposing laws meant for the transfer of Apple stock to your purchase and sale of an iPhone or, worse, to every text sent or received on your iPhone.”

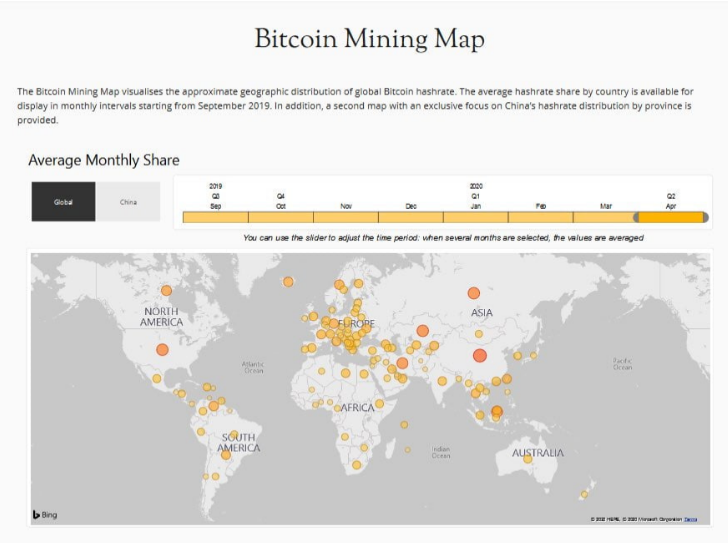

Ripple’s CEO believes that the lack of diligence in responding to the securities issued in the crypto space and the status of ETH and BTC which put the country at a disadvantage against China. With the Subsidies that the Chinese governments give to the miners connected to the networks, the mining pools get millions. Alderoty, therefore, claims that China controls 65% of Bitcoin’s mining and most of the ETH mining. He added:

“ (The US loses technological “Cold War” with China) that is exactly what the U.S. is allowing to happen. Ceding this innovation to Communist China raises national economic and security concerns.”

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post