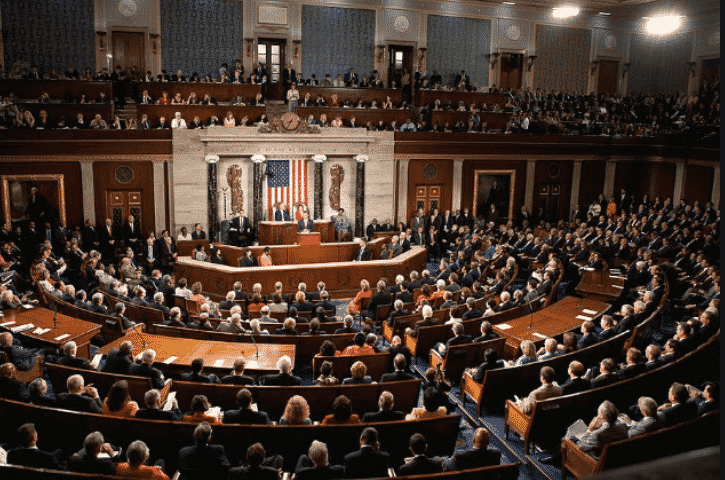

US lawmakers introduce new bill that is targeted at stablecoins after Representative Trey Hollingsworth and Senator Bill Hagerty partnered to launch the bill and bring a higher transparency level regarding the reserves controlled by the issuers so let’s read more in today’s latest cryptocurrency news.

Stablecoins are cryptocurrencies that usually peg 1:1 to fiat currencies such as the US dollar so for every stablecoin in circulation, there should be a $1 bill redeemable in the reserves, and the rising concern regarding the security of stablecoins caught the lawmakers’ attention. According to the press release, Bill Hagerty’s office noted that the new bill will require stablecoins to be backed by governemnt securities with maturities less than 12 months or US Dollars but does require stablecoins issuers to release audited reports of their reserves which are executed by third-party auditors. The US lawmakers introduce new bill hoping to bring more clarity.

The so-called Stablecoin Transparency Act is a clear indicator that American lawmakers are stepping up to hold the industry accountable and transparent. Transparency regarding stable coin issuers has been a huge issue over the past few years in this industry as Tether which is the centralized entity that issues USDT has been called out for its unclear data over the reserve status. As outlined in the release, the bill will not equip regulatory bodies with the power to regulate the industry out of existence and to impose the requirements on stable coin issuers.

The representative Hollingsworth revealed that the goal of the bill was not to stifle technological innovation and the bill will give the industry idea of what the regulatory compliances will be like in the future. Tether as the biggest stablecoin by market cap was caught in a series of criticism because of the lack of transparency regarding the status of the reserve. USDT is backed by basked of liquid assets but the company failed to disclose where the commercial papers were from on multiple occasions because of privacy reasons.

Last year it became a controversy that Circle the company behind USDC, held up to 61% of reserves in cash according to the reports by Grant Thronton. A month later, Circle converted the reserves entirely to cash and short duration US treasuries which is a move aimed to reassure the community of USDC.

buy furosemide online https://nosesinus.com/wp-content/themes/twentytwentytwo/inc/patterns/new/furosemide.html no prescription

Circle also held $50B worth of reserves with the Bank of New York Mellon.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post