The new Singapore law on crypto demands only overseas operators to be licensed and they will have to meet all the anti-money laundering measures for which they were not previously regulated so let’s find out more in today’s latest cryptocurrency news.

The Singapore parliament passed a new law on Tuesday that will require overseas crypto businesses to be licensed. Right now, the Singapore law on crypto claims that the crypto entities in the country are not regulated for anti-money laundering and countering terrorism so the move is aimed at tightening the rules for the crypto providers. Singapore is now going on a tightrope of both welcoming Web 3companies while issuing guidelines to limit the ads for crypto in public spaces.

The new rules come as a part of the Financial Services and Markets Bill which includes the imposition of a higher maximum penalty of million on financial institutions if they experienced cyberattacks for certain services or if they are being disrupted.

buy vigora online gilbertroaddental.com/wp-content/themes/twentyseventeen/inc/en/vigora.html no prescription

The bill gives greater power to the Monetary Authority of Singapore to ban individuals that are deemed unfit from performing key roles, functions, and activities in the financial industry and these will include individuals that provide payment services and conduct risk management.

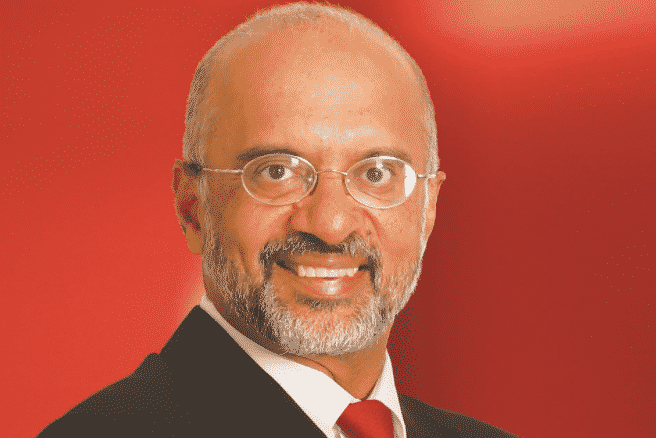

As recently reported, The CEO of Singapore’s DBS Bank Piyush Gupta revealed that his institution will not extend the crypto trading services to retail customers in the near future and the announcement contradicts the company’s initial plans to provide such opportunities. The banking giant disclosed previously that it will extend crypto trading opportunities to the retail client by the end of 2022. the bank aimed to make these processes accessible by facilitating online deposits and transactions without having to depend on intermediaries. However, Chief Executive Officer Piyush Gupta said that the local watchdogs are concerned about allowing crypto in the retail sector so the bank decided to withdraw its plans.

The top executive displayed a positive stance on crypto and described the asset class as an alternative to gold with its role in the current monetary system. Gupta also said that right now the volatility of the market doesn’t allow digital assets to become “money as we know it.”

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post