IRS deals with crypto tax evaders by simply asking them questions that can be answered with yes or no as we are about to find out in our latest cryptocurrency news.

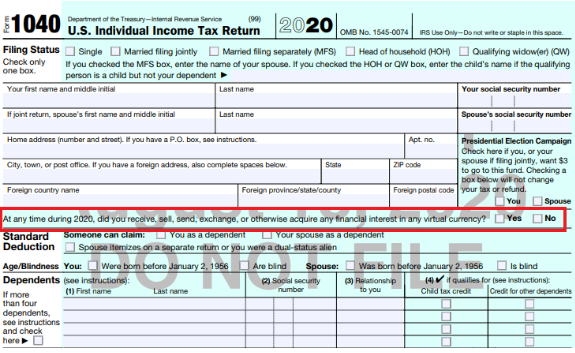

2020’s federal income tax form 1040 was designed to ensure that all taxpayers have to answer a crypto-related question. Experts believe that the IRS deals with crypto tax evaders by asking them simple yes or no questions. Starting this year, the US Internal Revenue Service is increasing the priorities on cryptocurrency taxations. The personal federal income tax form 1040 will include a mandatory Yes/No question that is related to the taxpayers’ use of virtual currencies and these questions will become a part of the form from now on. However, it was positioned to enable some people to avoid having to fill it out.

According to the reports, the new questions are designed to trap the crypto tax evaders and help the IRS win the court cases. The Internal Revenue Bulletin 2014-16 is considered primary guidance on the taxation of virtual currencies and the IRS said describing the taxable events:

“In general, the sale or exchange of convertible virtual currency, or the use of convertible virtual currency to pay for goods or services in a real-world economy transaction, has tax consequences that may result in a tax liability.”

This tactic proves effective in the past when the agency added a question regarding offshore bank accounts which resulted in a recovery of taxes that were worth $12 billion. The internal revenue organization in Russia and the UK are increasingly active in their pursuit of crypto tax evaders and the Financial Action Task Force is also boosting enforcement of the travel rule that will fight money laundering. If this is successful, the revenue services across the world will be able to collect taxes on crypto.

As recently reported, One of the top big four accounting firms EY has just launched a crypto tax service for calculating the taxes imposed on cryptocurrencies. Ernst & Young announced the new service so now Traders can use EY CryptoPrep to get to know the tax percentage when filing taxes on their crypto trades. EY’s service came after the increased pressure from the IRS to tax the capital gains form crypto trading and the top big four accounting firms launched the service of its in-hour crypto tax service CryptoPrep.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post