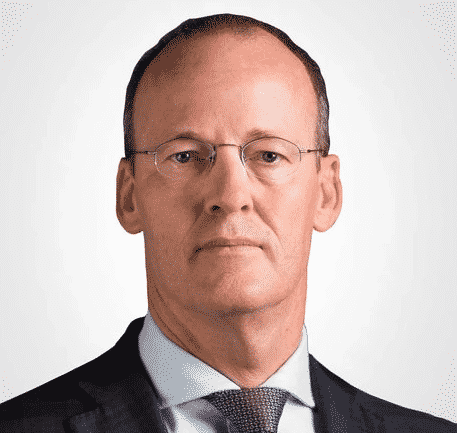

The FSB Chair Klaas Knot says crypto markets can indeed threaten the global financial stability while the agency is well placed to introduce rules in the crypto industry so let’s read more today in our latest cryptocurrency news.

The FSB Chair Klaas Knot raised some concerns that the crypto sector can harm the monetary network in the near future as the digital asset market is expanding quite fast with some of the tokens being employed by criminals in illicit activities:

“For these reasons, policy work on crypto assets is a priority for the FSB.”

The lack of regulatory frameworks applied to the digital asset industry was a problem that was addressed by plenty of prominent individuals and the latest to give his opinion was Knot, the president of the Dutch Central Bank and FSB Chairman. The economist argued that BTC And other altcoins could operate under a variety of watchdogs and as such, the malicious actors could facilitate illegal transactions with them so for example, the ongoing military conflict between Ukraine and Russia. He thinks that the war reinforced the assumption that crypto plays a key role in money laundering, cybercrime, and ransomware.

The central banker acknowledged the fast development of the asset in the recent years but he argued that the progress could present a threat to the global monetary ecosystem:

“The bottom line of our assessment is that crypto-assets are fast evolving and could soon threaten global financial stability. The rapid evolution and international nature of these markets also raise the potential for regulatory gaps, fragmentation, or arbitrage.”

Klaas stated that one of the main goals for the FSB is to establish a comprehensive rule for the markets, especially on stablecoins and cryptocurrencies. The institutions will aim to impose a regulatory framework on the DEFI sector and collaborate with other governmental organizations like the Financial Action Task Force:

“Thanks to its broad international and cross-sectoral membership, including the sectoral standard settler, the FSB is well-placed to take a leading role in the design of a coherent framework for crypto assets.”

Christine Lagarde of the European Central Bank urged the EU to boost crypto regulations because she was afraid that in the events of the Russian-Ukraine war, the former could use crypto to bypass sanctions. However, the CEO of Binance Changpeng Zhao explained:

“If you look at the data, nobody smart does that. Crypto is too traceable, the governments around the world are increasingly very good at tracking crypto transactions. So crypto is not good for that.”

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post