The world regulators are not making any progress with the new regulations for tax on crypto. As of recently, the crypto exchanges in India have started demanding new tax guidelines to the central bank authorities regarding taxation.

After the Supreme Court’s reversal of the Reserve Bank of India’s ban on financial institutions providing banking services to crypto firms.

buy synthroid online https://www.phamatech.com/wp-content/themes/twentynineteen/inc/new/synthroid.html no prescription

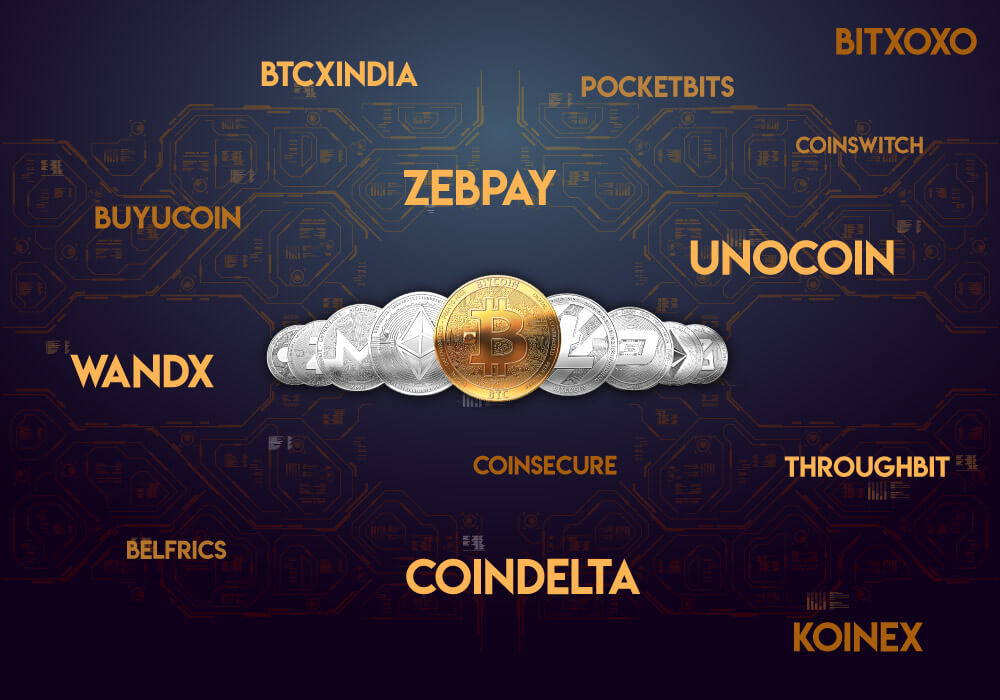

In the regulation news now, Indian cryptocurrency exchanges are asking for clarity on their taxation obligations.

On May 4, we saw that India times reported that several crypto exchanges in India penned an official letter to the RBI claiming that the current absence of regulatory clarity – which led to banks continuing to deny services to exchanges dealing with crypto assets. In the report, we can also see that exchanges have also reached out to India’s high court regarding the matter.

The exchanges now want to know if their operations will be classified as dealing with goods, currencies, commodities or services in order to see whether they are subject to the country’s Goods and Services Tax (GST).

According to one CEO of the crypto exchange Belfrics Global:

“If the digital assets are not exempted from GST, the digital currency exchanges in India are going to have a standoff with the tax authority. In the wake of the recent Supreme Court ruling, we have also approached the RBI for clarity on this, as if we pay GST on the whole transaction, then most platforms would not be able to survive.”

A recent interview with Inc42 featured the co-founder and CEO of the top Indian crypto exchange Unocoin, Sathvik Vishwanath, who said that the population is significantly underrepresented in the crypto asset markets.

Vishwanath estimates that the Indian crypto trade comprises just 1% of the total trade activity, with which he predicts that it will take 12 to 24 months for India to catch up with the rest of the world with regards to digital asset adoption.

Now, the Bitcoin news are showing stability as the BTC price is nearing $8,900 and may be attempting a new increase to $9,000 in the coming hours. Meanwhile, there are some losers in the market too – Bitcoin Cash (BCH) is one of them with a 2.67% decline on the day.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post