The CFTC ordered Polymarket to pay $1.4 million in penalties for violating the CFTC regulations as we can see more in our latest crypto news.

The Commodity Futures Trading Commission- the CFTC ordered Polymarket to pay a fine worth $1.4 million. The agency claimed that the company didn’t seek a Designated Contract Market or a Swap Execution Facility registration. Accoridng to the announcement, Polymarkt has to wind down the markets displayed on the website that don’t comply with the Commodity Exchange Act and the CFTC regulations. The Acting Director of Enforcement Vincent McGonagle noted that the derivatives markets have to operate within the law requirements regardless of the employed technology. The executive said that those in the Defi space should be even more monitored. McGonagle added:

“Market participants should proactively engage with the CFTC to ensure that our markets remain robust, transparent, and afford customers the protection provided under the CEA and our regulations.”

We’re pleased to confirm that we've successfully agreed to a settlement with the CFTC, & are excited to move forward & focus on the future of Polymarket.

As per the order, the 3 markets lasting past 1/14 that don't comply with the Act will be prematurely resolved. More soon

🔮— Polymarket (@PolymarketHQ) January 3, 2022

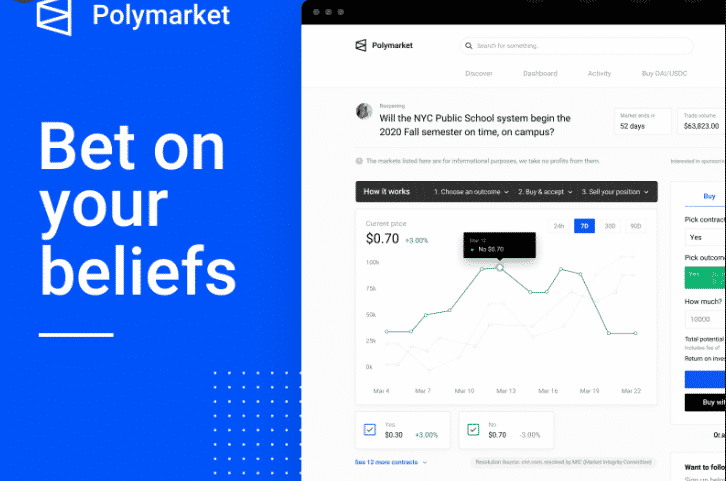

Before receiving the penalty, Polymarket agreed that the CFTC settlement is excited to move ahead and to focus on the future. Built on the Ethereum network, Polymarket is a decentralized prediction market that enables individuals to bet on the outcome of real-world events. Before the clients are able to start speculating, they have to deposit USDC into their wallets and can stake the assets on the future results of the highly-debated topics and to earn profits. Since the interception, the entity offered more than 900 separate event markets and some of the most popular ones include “will Ethereum be above $2500 on July 22” or “Will Donald Trump Win.”

Polymarket is not the first crypto-related company to be fined by the CFTC. Back in August last year, the Bitmex digital asset exchange had to pay $100 million after the governemnt agency accused the former of avoiding US regulations and the CFTC blamed the company for operating the unregistered derivatives platform. Right after, the Commission fined the trading venue Kraken with a $1.25 million civil monetary penalty and claimed that the latter allowed US customers to access products banned for them. Last October, the CFTC ordered Bitfinex and Tether to pay $42.5 million for breaking the law, and the organizations were also instructed to desist from further violations of the CEA.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post