The popular ABRA cryptocurrency wallet just got penalized by the SEC and CFTC for $300,000 after selling unregistered Stock swaps, as we are reading further in the upcoming crypto news.

Crypto app’s investment contracts broke US Securities law according to the SEC. The CFTC And SEC both charged the Abra cryptocurrency wallet with offering unregistered investment contracts and violating securities regulations. Abra will pay $300,000 in penalties to both agencies but it will still continue operating as a normal crypto wallet.

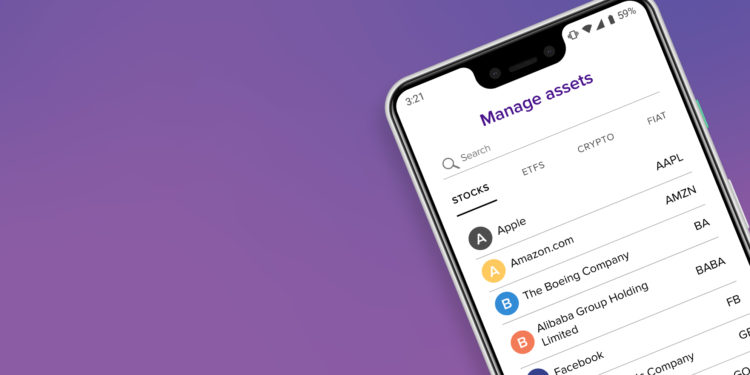

Abra is a multi-coin wallet that allows users to store and exchange cryptocurrencies and also allows users to invest their crypto in stocks and ETFs. The SEC explains that the users were able to bet on the price movement of the US-listed equity securities or enter the contracts that mirror the performance of the securities. According to the Securities and Exchange Commission, Abra violated securities laws by failing to use the registered securities exchange by also violating provisions around unregistered offers. The CFTC filed another charge against the company.

Abra first started offering securities swaps in February 2019 but it did not ensure the users were eligible to start buying securities. The SEC then shut down the feature in just a few days. The California-based app re-launched the same feature back in 2019 and offered it to users outside of the US. Plutus Technologies was responsible for this feature at that time. Despite the decision of the wallet to move the feature offshore, the SEC says that the wallet continued making security swaps. The company’s US-based employees continued the market swaps and screen the users that purchased contracts while some employees even purchased securities.

Abra and Plutus will pay a joint fee of $150,000 to the CFTC and SEC and will discontinue the securities swap feature for the app. It seems that the app will continue acting as a standard crypto wallet. Other wallets will not be targeted by the SEC at this time because of only a few support securities trading. Only specific crypto wallets and clients such as Bitcoin Core do not support exchanges. The SEC could take action against apps such as Exodus and Coinomi because these crypto apps rely on approved and already regulated exchanges.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post