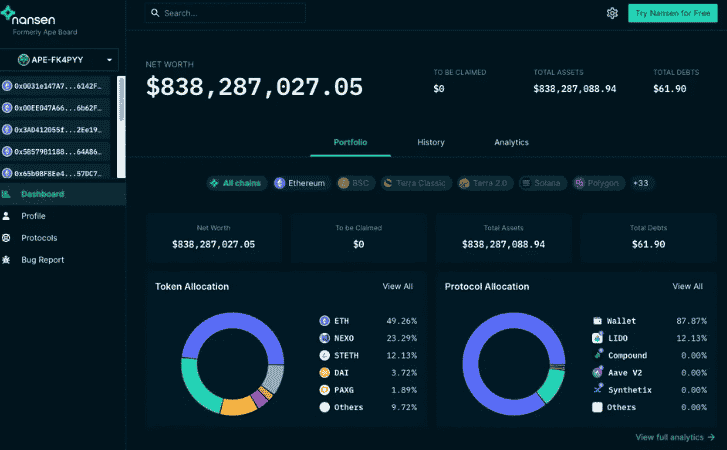

Nexo fights to clear its name saying that it is nothing like Celsius and that its corporate treasury has an $838 million balance so let’s read more today in our latest cryptocurrency news.

Some of the lender’s biggest wallets including the corporate treasury show the $838 million balance but the ongoing liquidity issues at Blockfi, Celsius and Voyager Digital put other lenders in the hot seat with some rushing to assure the clients their funds remain safe. Nexo however pointed to real-time attestations from Armanino as proof that it hasn’t gone the way of the competitors but also had to contend with a Twitter user who claimed its co-founder Kosta Kantchev embezzled funds from a charity to build an enormous palace.

The company printed a rebuttal that dismissed the accusations as a case of mistaken identity and wrote that the account was using lies and distortion in another smear campaign against Nexo. The legal department got involved as well and send a cease and desist letter to the Twitter account. Nexo co-founder Antoni Trenchev added:

“He claims a lot of things, but that we are insolvent. is not one of them. It’s a prediction that we will be insolvent by the end of the year, and they haven’t backed this up in any meaningful way.”

Trenchev added that Nexo fights to clear its name and it only appears to be like other crypto lending competitors which often take client funds and stake them in yield-generating protocols or make what he considers collateralized loans. Nexo loans out client funds and uses the proceeds to pay interest so Nansen also identified more than 50,000 wallets that belong to Nexo that including the one that Nansen identified as the corporate treasury. It had a balance of $169 million as of Tuesday morning while most of the funds were in staked Ethereum.

Nansen CEO Alex Svanevnik showed that a few of the biggest wallets of Nexo, have a balance worth $838 million and half of that was being held as ETH and the rest in the native NEXO token. Another of the company’s wallets showed that Nexo deposited $579 million worth of Wrapped Bitcoin as collateral in a MakerDao vault and had a balance of $50 million DAI. Unlike its competitors, Nexo said it only makes over collateralized loans which means they tend to pay lower yields than BlockFi and Celsius but then exposes clients to no risk according to the website. Trenchev added:

“We have invested while times were good for the space. During that time, 18 months I think it took us, we worked with Armanino, which is a top 20 auditor in the U.S., to develop a real-time attestation that our assets exceed our liabilities by more than 100%.”

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post