Nexo doubles the interest rates and will also implement a new “Earn in NExo” feature to attract more users as we are reading more in today’s Nexo news.

The crypto lending platform Nexo announced they will double the interest rates in order to fight against the market volatility. The users will receive twice the previous rate of interest of ten high-cap cryptocurrencies and the new feature will also allow clients to collect interest in the token which offers an additional 2% APY for digital and fiat assets. Nexo doubles the interest rates to fight the market volatility due to the geopolitical circumstances as the cause of the update. Nexo which was launched by Credissimo, made the decision earlier today.

The new rates are a response to the rising volatility and uncertainty on the market which Nexo attributed mostly to the COVID-19 pandemic and the upcoming US Elections. The usres can choose to collect interest in the native token using the Earn on Crypto product. The update is the start of the “nexonomics” initiative which is aimed at making improvements to the NEXO token on the platform. The company stated that the improvements will deal with the tokenomics utility and the native currency’s underlying value. The company now offers double the interest on BTC, ETH, BCH, XRP, LTC, EOS, LINK, TRX and PAXG with rates of 8% APY.

In total, the two-fold increase in interest rates reaches 1% hike in the standard interest. the co-founder of the platform and managing partner Antoni Trenchev described the company’s strategy as “market neutral” by saying:

“With volatility rife around the second COVID wave and exacerbated by the US elections, we want to give our clients the financial stability and opportunities to guarantee their peace of mind – now and for the future.”

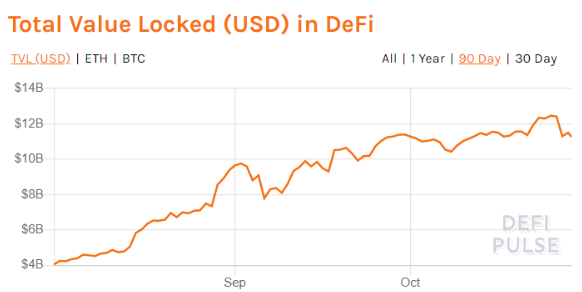

The move could be a part of the company’s efforts to remain competitive in the growing Defi space. Nexo was founded in 2014 and prove to be disruptive because of the ability to slash borrowing costs and paying out more interest to users than traditional financial services. With the growing number of Lending protocols in Defi and with more than $11.27 billion in assets now locked in the ecosystem, NEXO could be getting a smaller chunk of the market.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post