NEM’s Symbol blockchain which was recently released is slowly gaining more adoption by central banks and crypto startups. Symbol is a hybrid blockchain but has enterprises in mind which brings together the advantages of private and public blockchains to provide the best options for enterprise users and customers, as we are reading more in our NEM news what is NEM doing to boost the adoption more.

The launch of Symbol marks a focused effort towards providing services to the security token arena and making full use of the widespread flexibility and functionality. Today, we will outline the two instances of adoption of Symbol by the promising startup and a central bank.

The first example comes from the recently announced collaboration between Wave Financial and NEM to launch Bourbon Fund tokens. This partnership will mark the first security token launched with the help of Symbol. The launch is expected to occur in late 2020. Representatives from Wave Financial and NEM group commented on their collaboration. The Chief Investment Officer of NEM Group and Managing Director of NEM Ventures Dave Hodgson said:

“I am delighted to see the first committed security issuance on Symbol from NEM, even before its launch. We have been working with Wave Financial since early 2020 to tokenize this unique asset class and it is exciting to see this progress. The Wave team have prior experience of digital asset tokenization are consummate professionals – the perfect partner for our first security token.”

David Siemer, CEO of Wave Financial, continued:

“After launching the fund, we were on the lookout for a protocol that would facilitate this unique offering. Symbol from NEM was a natural fit, due to its technical capabilities, purpose-built with the issuance of security tokens at the forefront of its network architecture.”

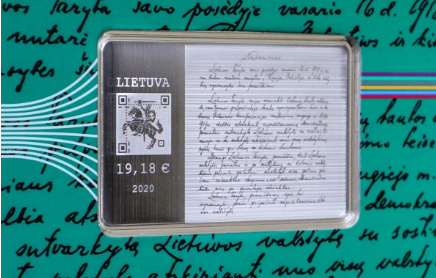

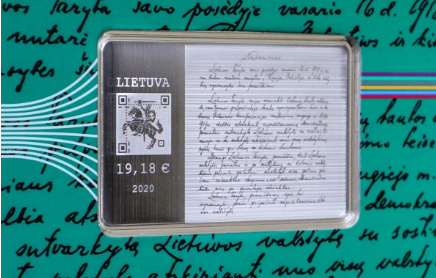

Central Bank currencies are now the main point of talk in the crypto community. Various countries around the world are developing and researching their own versions. One example is the Bank of Canada and the other is the Bank of Lithuania. The Central bank of Lithuania prepares for the future with digital currencies as they announced the pending release of LBCOIN. LBCOIN is not actually a central bank digital currency but a collectible token on the Symbol blockchain issued by the Central bank of Lithuania. Its goal is to provide valuable insight into the functionality associated with the eventual release of CBDCs.

NEM’s Symbol blockchain which was recently released is slowly gaining more adoption by central banks and crypto startups. Symbol is a hybrid blockchain but has enterprises in mind which brings together the advantages of private and public blockchains to provide the best options for enterprise users and customers, as we are reading more in our NEM news what is NEM doing to boost the adoption more.

The launch of Symbol marks a focused effort towards providing services to the security token arena and making full use of the widespread flexibility and functionality. Today, we will outline the two instances of adoption of Symbol by the promising startup and a central bank.

The first example comes from the recently announced collaboration between Wave Financial and NEM to launch Bourbon Fund tokens. This partnership will mark the first security token launched with the help of Symbol. The launch is expected to occur in late 2020. Representatives from Wave Financial and NEM group commented on their collaboration. The Chief Investment Officer of NEM Group and Managing Director of NEM Ventures Dave Hodgson said:

“I am delighted to see the first committed security issuance on Symbol from NEM, even before its launch. We have been working with Wave Financial since early 2020 to tokenize this unique asset class and it is exciting to see this progress. The Wave team have prior experience of digital asset tokenization are consummate professionals – the perfect partner for our first security token.”

David Siemer, CEO of Wave Financial, continued:

“After launching the fund, we were on the lookout for a protocol that would facilitate this unique offering. Symbol from NEM was a natural fit, due to its technical capabilities, purpose-built with the issuance of security tokens at the forefront of its network architecture.”

Central Bank currencies are now the main point of talk in the crypto community. Various countries around the world are developing and researching their own versions. One example is the Bank of Canada and the other is the Bank of Lithuania. The Central bank of Lithuania prepares for the future with digital currencies as they announced the pending release of LBCOIN. LBCOIN is not actually a central bank digital currency but a collectible token on the Symbol blockchain issued by the Central bank of Lithuania. Its goal is to provide valuable insight into the functionality associated with the eventual release of CBDCs.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post