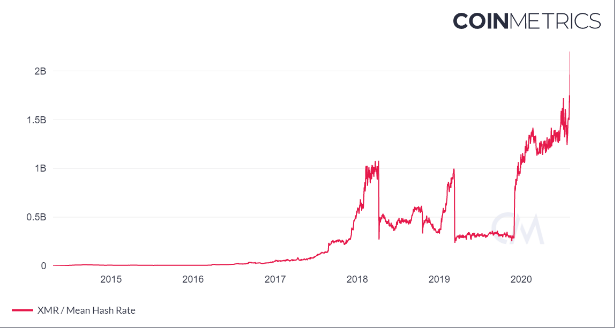

Monero’s hashrate hits its biggest gains ever in one single day since its creation back in 2014 as we are reading more in our latest XMR monero news.

Monero’s hashrate experienced its biggest increase since it was created, from 1.67 GH/s to 2.2 GH/s on August 6. The increase in one single day is the highest in the project’s history. Before this, the most important daily percentage gains came in the project’s early days when the XMR base was much smaller. Coin Center submitted comments to the Office of the Comptroller of the currency on the National Bank and Federal Savings Association Digital Activities. The comments suggested that the banks will have to embrace privacy coins rather than fighting them:

“We argue that Banks should not only be able to use trustless mixing tech (coinjoin) or privacy-enhanced crypto (zcash/monero) but that they may be obligated to do so in order to protect the privacy of their customers.”

It’s still unclear what led to this explosion in Monero’s hashing power. In today’s world where many feel that they are becoming subject to the ever-increasing level of surveillance, Monero could present a unique value proposition. A number of recent reports indicated that Monero remains the best privacy-based cryptocurrency while other assets such as Zcash or Dash can be traced with relatively easy. Monero presents a huge challenge which is why some exchanges decided to delist it.

Monero trails only BTC in its adoption rate amongst the Dark Web dealers as they are looking for privacy-oriented features that are sometimes literally a matter of life and death. For example, Coinbase still hasn’t listed Monero’s XMR on its platform but the reasons are still not quite certain because of the ongoing chats with regulators that have the exchanges being extremely cautious about privacy coins.

The Coinbase CEO explained on his podcast why Coinbase hasn’t listed Monero yet, mainly focusing on regulators and their discomfort with privacy coins as he said that a more conservative approach to listing something will be Binance or Kraken. Monero is now ranked as the 16th largest cryptocurrency with a total market cap of more than $1.27 billion while exchanges such as Kraken and Binance list it, so why can’t Coinbase?

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post