Privacy coins Monero and Zcash are leading the crypto market rebound but the political events in Russia and the US could be behind the rising popularity in these cryptocurrencies so let’s read furhter in today’s latest Monero news.

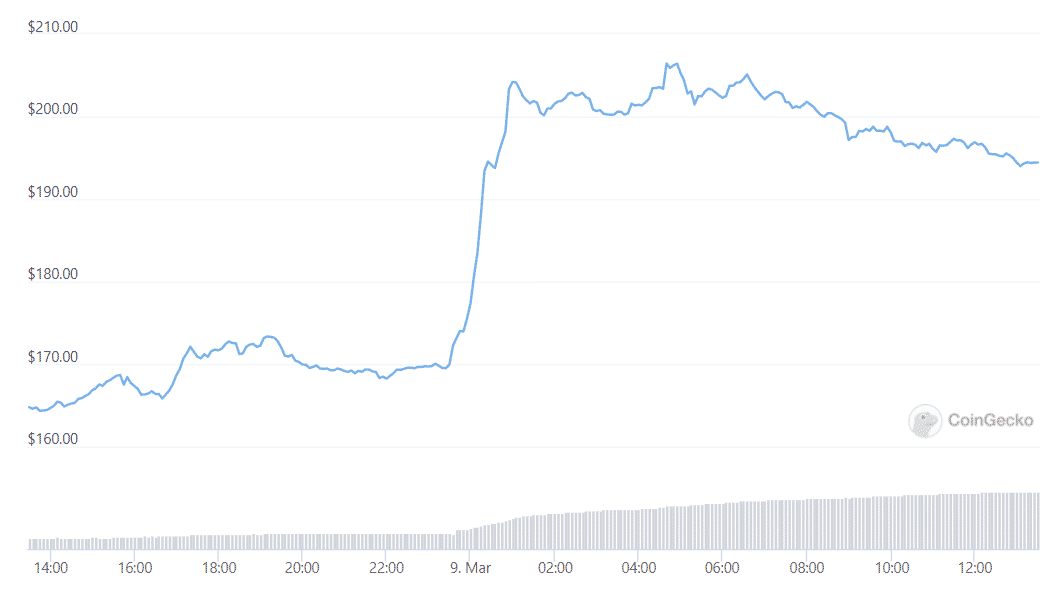

The top privacy coins Monero and Zcash are surging in value today and posted gains from 10-20%. The biggest privacy coin Monero has a market cap of over $3.5 billion, increased by 18.8% in the past day and it is trading for $195 but despite the rise, it is still 64% short of the former ATH of $517 which was set back in May 2021.

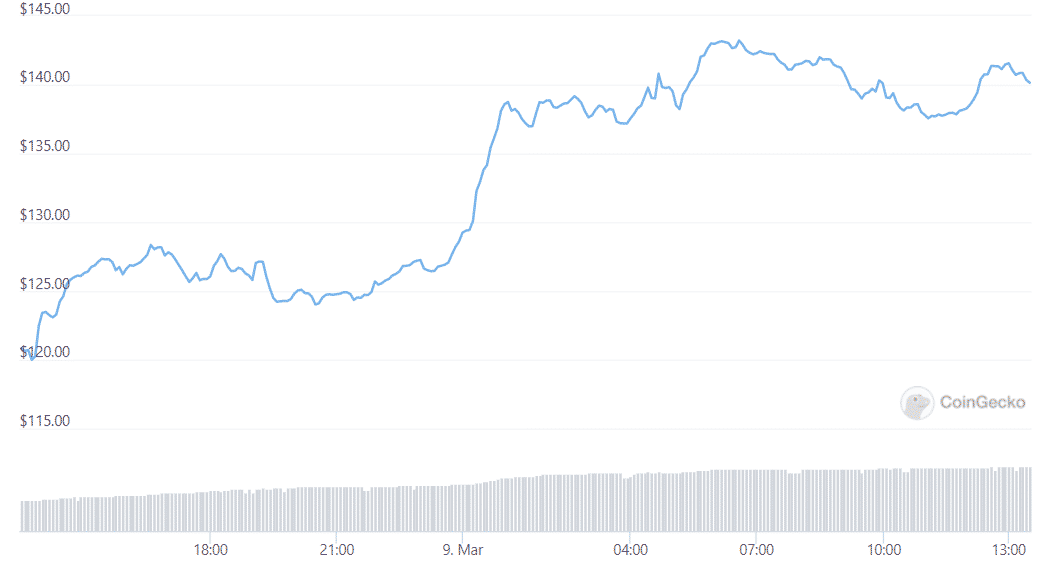

Zcash is up by 17% today and it is trading near $131 at the time of writing. Just like Monero, it is still far from recapturing its previous ATH of $5,941 which was set back in October 2016. Horizon and Secret which are the fifth and third-biggest privacy coins by market cap are rallying as well. Secret made gains of 14.5% and hit $4.9 while Horizen increased by 17% to reach $41.14. outside the privacy coins, plenty of alternatives are rallying as well. Pirate chain is up by 18%, Verge by 24%, and Dero by 16%.

The privacy coins vary in utility and methods but often they use cryptographic techniques to obscure identifying information like addresses and transaction amounts from the prying eyes. Both Monero and Zcash use a technique called zero-knowledge proofs which allows users to make transactions without having to specify the details about the transactions in question, other than the fact that they are legitimate. While Monero allows private transactions only, Zcash allows for public ones.

As crypto becomes more mainstream, there are plenty of governments across the world that think now is the best time to start creating legislation and minimize potential damage by developing a digital economy that can impact the traditional markets. Legislators are also looking for a safeguard against adverse market movements but also actors. The Biden administration released more details from the executive order from the White House to clarify the roles of the agencies like the SEC and the CFTC in regards to crypto.

In the meantime, Russia’s central bank banned foreign currency withdrawals of over $10,000 until September in order to slow the outflow of capital after the community imposed heavy economic sanctions after Russia’s attack on Ukraine. With crypto falling under the microscope, the market activity suggests that investors could be flocking to other privacy coins as well.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post